Net Present Value Calculator

Click here to get more Free Online Business Calculators.

Click here for more Finance and Investment Calculators.

How to Use the NPV Calculator

To use the Net Present Value (NPV) calculator, begin by selecting your preferred currency. Next, input your initial investment amount, which is the capital you are putting into the project or investment today.

- Entering Cash Flows

- For a fixed yearly cash flow, simply enter the amount you expect to receive at the end of each year.

- If your cash flows vary each year, select "Yearly Variable Cash Flow" and input the different amounts for each subsequent year.

- Discount Rate

- This is the rate at which you discount future cash flows back to their present value. It represents the risk and potential returns from alternative investments.

- Calculate

- Once you've inputted all the necessary details, click on "Calculate NPV" to see the net present value of your investment.

- Reset

- If you need to start over, the "Reset" button clears all fields, allowing for new calculations.

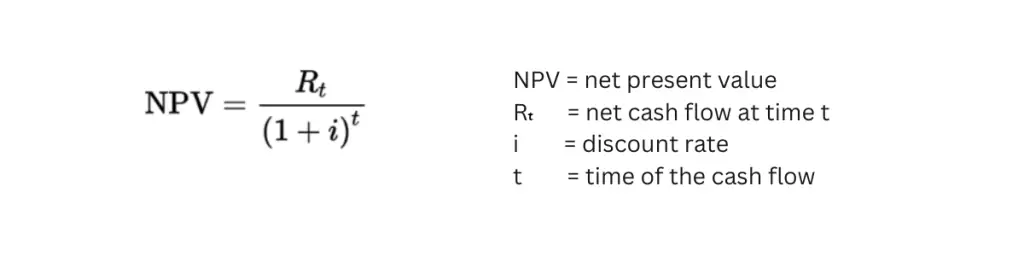

What is NPV?

Net Present Value is a financial metric used to evaluate the profitability of an investment.

It helps investors understand the return on investment by comparing the amount invested today to the present value of future cash flows.

Who Can Use It?

The NPV calculator is a versatile tool beneficial for:

- Business owners evaluate new projects or capital expenditures.

- Investors consider the potential returns on different investment opportunities.

- Financial Analysts are conducting cash flow analysis for valuation purposes.

Where Is It Useful?

NPV is particularly useful in:

- Capital Budgeting to determine the value of long-term investment projects.

- Investment Analysis to compare the profitability of various investment options.

- Loan or Mortgage Decisions to evaluate the financial viability.

FAQs

Why is NPV important?

NPV provides a clear indication of how much value an investment or project is expected to generate, considering the cost of capital and the risk involved.

Can I use NPV for personal finance decisions?

Absolutely! NPV can be a practical tool for personal investment decisions, like buying real estate or evaluating long-term financial commitments.

What if my NPV is negative?

A negative NPV suggests that the expected cash flows, discounted for risk and time, do not cover the initial investment. It might be wise to reconsider the investment or adjust your assumptions.

How does the discount rate affect NPV?

The higher the discount rate, the lower the present value of future cash flows, which can result in a lower NPV. It reflects the principle that money available in the future is worth less than money in hand today due to inflation and the opportunity cost of capital.

Whether you're evaluating a single project or comparing multiple investment opportunities, the NPV calculator helps to ensure that your financial planning is grounded in solid, quantitative analysis.

Remember, a positive NPV signifies an investment that is likely to yield returns above the cost of capital, steering you toward financial decisions that could lead to growth and success. Embrace the power of financial foresight with our NPV calculator.