Simple Savings Account Calculator

Interest Earned: $0

Total Contribution: $0

Total Savings: $0

Click here to get more Free Online Business Calculators.

Click here for more Finance and Investment Calculators.

How to Use This Simple Savings Calculator

Step-by-Step Guide:

- Select Your Currency: Choose from options like USD, EUR, GBP, and more to match your savings plan.

- Enter Your Initial Investment: Input the amount you’re starting with in the designated field.

- Monthly Contribution: Specify how much you’ll add to your savings each month.

- Annual Percentage Yield (APY): Fill in the expected yearly interest rate.

- Savings Period: Decide on the duration of your savings plan in months or years.

- Calculate: Click the ‘Calculate’ button to see your potential savings growth.

- Note: This calculator takes the default monthly compounding of interest. (Annual interest rate is divided by 12)

Understanding the Savings Method

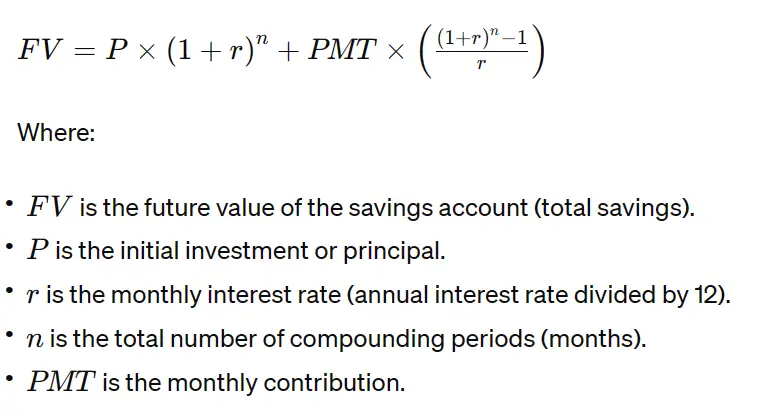

Our calculator employs a compound interest formula to project the growth of your savings over time.

It takes into account your initial investment, monthly contributions, and the compounding interest rate to provide you with an estimate of your total savings, total contributions, and interest earned.

Who Can Benefit?

- Personal Savers: Whether you’re saving for a big purchase, an emergency fund, or retirement, this tool helps you plan ahead.

- Students: Plan your savings strategy for tuition fees or start building your emergency fund early.

- Investors: Get a clear picture of how regular contributions can boost your investment portfolio over time.

Where It’s Useful

- Budget Planning: Integrates seamlessly into personal and family budget plans.

- Financial Education: An excellent tool for educators teaching the basics of saving and compound interest.

- Investment Strategy: Helps investors understand the power of regular contributions.

FAQs

What is Annual Percentage Yield (APY)?

APY refers to the annual rate of return that takes into account the effect of compounding interest. Unlike simple interest, which is calculated only on the principal amount, compounding interest is calculated on the principal amount and also on the accumulated interest over previous periods.

How often should I contribute to my savings?

The frequency of your contributions depends on your financial situation and goals. Monthly contributions are common and can help build savings consistently over time. Adjust your contribution frequency and amount based on your income, expenses, and savings targets.

Can I use this calculator for different currencies?

Yes, our calculator supports multiple currencies, making it a versatile tool for users worldwide. Simply select your preferred currency from the dropdown menu to start planning your savings in your local currency.

How does compound interest work in this calculator?

Compound interest is calculated on the initial principal and also on the accumulated interest of previous periods. The calculator shows how your savings can grow faster over time as the interest compounds.

Is it better to save for a longer period?

Generally, the longer you save, the more you benefit from compound interest, leading to significant growth in your savings over time. However, the best savings period depends on your personal and financial objectives.

Can this calculator help me with retirement planning?

Absolutely. While this calculator provides a basic overview of how your savings can grow over time, it can be a starting point for retirement planning by helping you estimate how much you need to save monthly to reach your retirement goals.

Conclusion

Our Simple Savings Calculator is designed to provide you with a clear, concise view of how your savings can grow over time using compound interest.

It’s an essential tool for anyone looking to plan their financial future, offering flexibility in currency selection, adjustments for various investment inputs, and visually appealing results through dynamic charts.

Whether you’re saving for a specific goal, building an emergency fund, or enhancing your investment strategy, this calculator simplifies the process and guides you toward making informed decisions.