Capital expenditure is an outlay of money by a company for an asset that will provide future economic benefits. These assets can be tangible, such as buildings, land, or equipment, or intangible, such as patents and copyrights.

It can be a major investment for your business and should not be taken lightly. Consult with your financial advisor to determine your business’s best action.

This blog post will clarify all your doubts about capital expenditure by looking at its definition, examples, types, and formula with calculation. The blog will also help you understand its benefits, challenges, and management of it.

Evaluate your Capital Expenditure using our Online Capital Expenditure Calculator

Evaluate your Net Present Value using our Net Present Value Calculator Online

Definition

It is an outlay of money to purchase or improve long-term assets such as property, plant, or equipment. It’s also referred to as capital spending, capital outlays, or investment in fixed assets.

Essentially, It represents the funds a company uses to expand and improve its operations. The money can be used to purchase new physical assets such as machines or buildings, or it can be used to upgrade or replace existing ones.

The main goal of it is to increase a company’s productive capacity and help it generate more revenue in the future. However, it also serves another important role by assisting companies to retain their competitive edge in the market.

Examples

- One of the examples might be purchasing a new machine or building to increase manufacturing capacity.

- Another example might be upgrading an existing asset, such as replacing outdated equipment with newer, more efficient tools.

Types

Depending on a company’s specific needs and goals, there are many different types. Some of the most common include,

- Equipment and machinery acquisitions

- Facility upgrades or expansions

- Technology upgrades, such as software or hardware purchases

- New construction or renovation projects

- Land and property purchases

- Research and development activities

- Building construction or renovation

- Business expansions or improvements

Formula

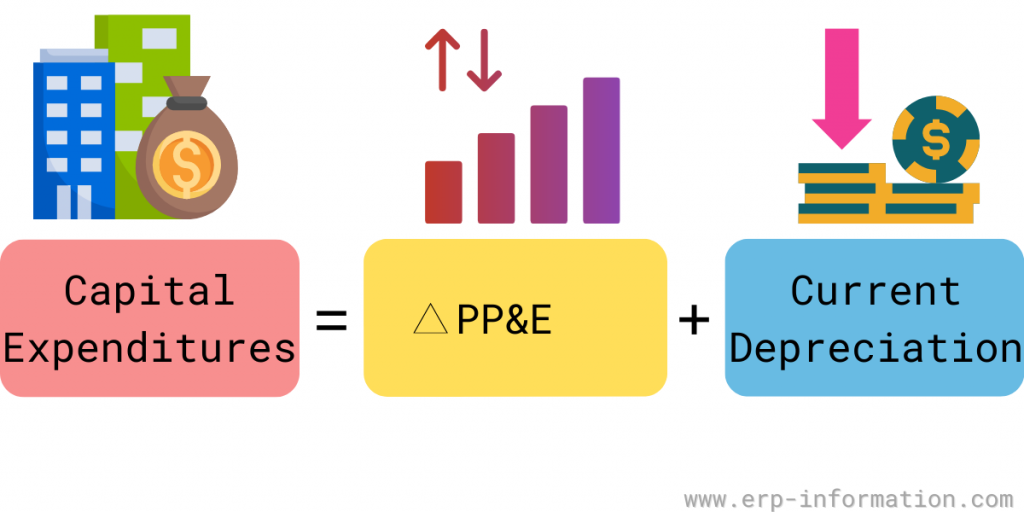

The calculation of CapEx is a straightforward process. Generally, the following equation is used:

Capital expenditures = ΔPP&E + Current Depreciation

Here,

ΔPP&E means a change in property, plant, or equipment.

A current depreciation is a time-dependent decline in the values of fixed assets.

It’s important to note that it does not include spending on research and development or marketing campaigns.

Calculation

Example

If an enterprise has $1M in property, plant, and equipment and plans to spend an additional $500,000 on upgrading its manufacturing capacity, the calculation would be as follows:

Capital expenditure = ($1M + $500K) – $1M = $500K

That means the company’s total capital expenditure for that period would be $500,000.

Benefits

Increased profitability and competitiveness

This investment allows companies to increase productivity, boost output, and improve overall efficiency.

Enhanced operational capabilities

Companies can gain access to new functional capabilities that help them better serve their customers and adapt to changing market conditions by investing in assets such as machinery, tools, or facilities.

Greater access to resources

Companies can access new physical resources and capabilities by expanding or upgrading assets.

Increased innovation

It allows companies to invest in new technologies and research and development activities, which can help them stay ahead of the curve and develop innovative new products or services.

Greater organizational flexibility

By investing in assets, companies can become more agile and adaptable, allowing them to respond quickly to changing market conditions and stay competitive over the long term.

Challenges

Availability of resources

It requires significant investments in time and money, which can be challenging for businesses with limited budgets or other financial constraints.

Difficulty forecasting returns

Forecasting the ROI of capital investments can be difficult, especially if a company is making large, complex investments or entering new markets.

Need for oversight and management

Managing and overseeing expenditures requires careful planning, coordination, and organizational skills, which may be difficult for some businesses to manage effectively.

How to manage it in a business?

Develop and implement a strong budgeting process

One of the most important steps for effectively managing it is developing a clear and well-defined budgeting process that considers your organization’s unique needs, goals, and resources.

Prioritize investments based on ROI and strategic goals

Carefully evaluate the potential returns of different expenditures to ensure that you invest in projects that deliver the greatest value to your business.

Work collaboratively with internal stakeholders and partners

Effective CapEx management often requires close collaboration with internal teams and external partners, such as vendors or consultants.

Leverage technology and automation tools where possible

In today’s digital landscape, a wide range of tools and technologies are available to help businesses streamline and automate the management of their capital expenditures.

Stay on top of changing market conditions and industry trends

It is essential to know the latest developments and trends in your industry and to adjust your expenditure strategy accordingly.

The accounting rules of capital expenditure

- It must be for the benefit of the company.

- All capital expenditures must be authorized by management.

- The costs of it must be accounted for in the period incurred.

- The depreciation or amortization of capital expenditures must be recorded in the period incurred.

- Capital assets must be classified and reported under GAAP(Generally accepted accounting principles)

Is Capital Expenditures Tax Deductible?

Yes, in most cases, they are tax deductible. However, some exceptions and restrictions may apply, so it’s important to consult with a tax professional to ensure that you are eligible for the deduction.

What is the Difference Between Capital Expenditure and Operating Expenses?

Capital expenditures are funds used to purchase, improve, or extend the life of a business asset. At the same time, operating expenses are funds used to cover the business’s day-to-day costs.

Conclusion

Whether a company is looking to expand, modernize its operations, or gain a competitive edge in the marketplace, capital expenditure can be an extremely valuable tool for businesses of all sizes and types.

By carefully evaluating their needs and opportunities, companies can make smart investments that help them achieve their goals and position themselves for success in the years ahead.