The actual cost is the real cost of a product or service after the deductions and adjustments have been made. Understanding this definition is essential for businesses to make sound business decisions that reflect a product’s or service’s actual costs.

Without accurate information, businesses can’t possibly hope to make sound decisions about allocating resources.

This blog post will explore the actual cost definition, details, formula, and calculation. We’ll also provide some examples to help illustrate this concept.

Evaluate your actual cost with our Actual Cost Calculator

Calculate your product’s actual cost with our Actual Production Cost Per Unit Calculator Online

Definition

The actual cost is a product’s or service’s correct, accurate price. It should include all expenses incurred in producing and delivering one item to its final destination, including indirect costs such as administrative overhead, depreciation charges for capital equipment used in production, labor, delivery costs, and other related items.

Actual costing is recommended when each production process is analyzed to determine the production costs at each phase.

It is essential when determining production costs because it can give a more accurate estimate than other methods, like estimating or break-even analysis.

This concept has been around since 1938, when it was first introduced by Professor Jules Mairesse, who published his theory on the subject in an article titled “The Economic Role of Accounting.” Today, we use this process with manufacturing and services, where there are typically no tangible assets to account for, like consulting firms.

Actual cost formula

The formula for calculating it is as follows.

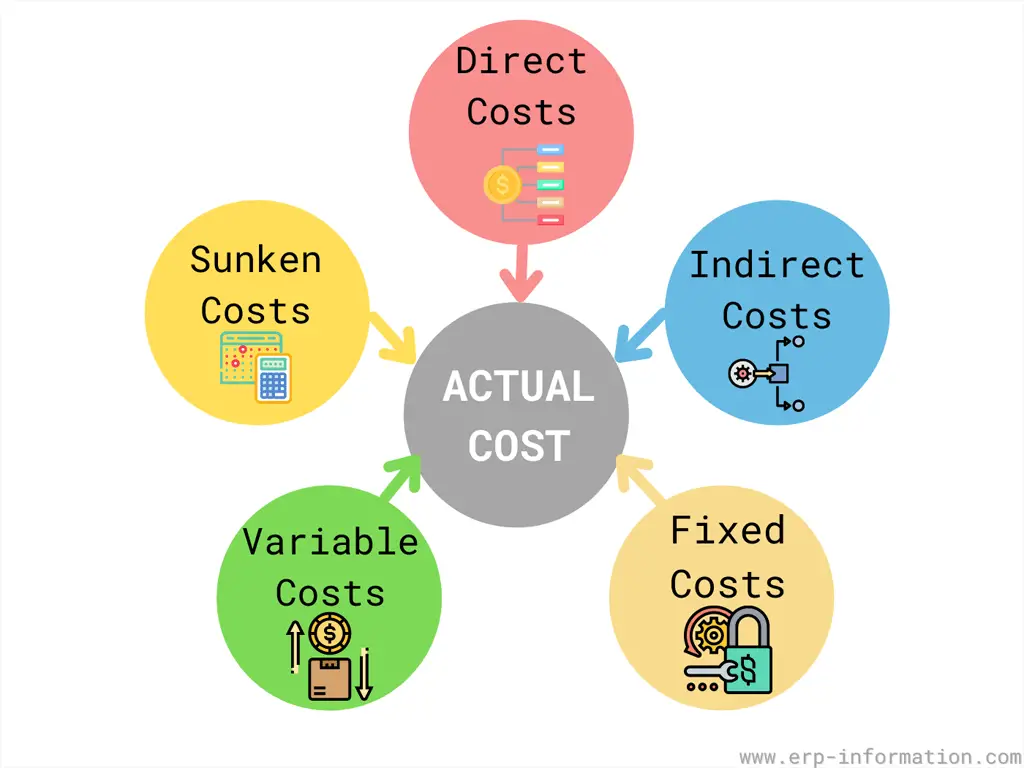

Actual Cost = Direct Costs + Indirect Costs + Fixed Costs + Variable Costs + Sunken Costs

Below is the meaning of the factors used in the actual cost formula.

- Direct costs: This is the precise cost that is directly related to your processes, such as fixed costs and variable costs

- Indirect costs: These costs are additional or extra costs to support your process, like administrative charges

- Fixed costs: A fixed cost is a cost that cannot be lowered or increased. Fixed Costs refer to expenses that do not change with changes in output or sales volumes – instead, they remain constant regardless of the level of business activity. Examples may include property taxes, equipment rent/lease payments, and labor-related expenses such as a company secretary.

- Variable costs: This is the cost that varies during the process—for example, labor charges.

- Sunken costs: This is the cost that occurs due to an error during the process

If you are manufacturing products, one more for calculation of actual cost is as follows.

Actual production cost per unit = (Actual material cost + Actual labor cost + Actual overhead cost) / Number of units produced

Where,

- Actual material cost = (Number of units of material used) X (Per unit cost)

- Actual labor cost = (Labor hours used in production) X (Wage paid per hour)

- Actual overhead cost = Addition of all overhead expenses (electricity, rent, insurance )

Calculation

Based on the above formula, the calculation is

Assume:

- Number of units of material used = 500 units

- Per unit cost of material = $5

- Labor hours used in production = 200 hours

- Wage paid per hour = $10

- Overhead expenses: Electricity = $500, Rent = $1000, Insurance = $300

- The total number of units produced = 1000 units.

Now, calculate the actual material cost:

Actual material cost = Number of units of material used × Per unit cost = 500 units × $5 = $2500.

Next, calculate the actual labor cost:

Actual labor cost = Labor hours used in production × Wage paid per hour = 200 hours × $10 = $2000.

Then, calculate the actual overhead cost:

Actual overhead cost = Electricity + Rent + Insurance = $500 + $1000 + $300 = $1800.

Now, let’s use these values to find the actual production cost per unit:

Actual production cost per unit = (Actual material cost + Actual labor cost + Actual overhead cost) / Number of units produced

Actual production cost per unit = ($2500 + $2000 + $1800) / Number of units produced

Actual production cost per unit = $6300 / 1000 units

Actual production cost per unit = $6.30 per unit

Therefore, the actual production cost per unit, considering material, labor, and overhead expenses, is $6.30 when 1000 units are produced.

Actual cost example

The actual product cost includes the price it took to make it. So, for example, a manufacturing company estimated $1500 for product repair. But the actual cost was $2000. So the company had a cost variance of $500.

Cost variance is the difference between planned or estimated costs and actual costs.

Here the actual cost is more than the estimated cost. Hence the cost variance is considered an unfavorable variance.

If the actual cost is less than the estimated cost, then the variance is called a favorable variance.

Cost variance is calculated for all cost components, including materials, labor, and overheads, and helps businesses adjust their financial plans and resource allocations accordingly.

For more details on variances read our article Purchase Price Variance (PPV).

Benefits

- It helps to calculate fixed costs for different stages of production.

- It is widely used in manufacturing sectors where more raw materials are utilized. It also enhances the inventory system and makes procurement easy.

- It assists in making several outsourcing decisions and also helps in setting up the correct prices for the products.

- It helps streamline procurement as it depicts the cost of all alternative sources of supply and helps choose the most feasible option.

Actual cost uses realistic numbers to ascertain the prices and helps decision-making an easy task. However, the disadvantage lies in the overhead expenses that can never be exact.

Even the labor charges vary, making it more challenging to use this technique than normal costing.

Also, this is useful in industries where the raw materials and other related factors are consistent with significantly fewer changes. It is ideal for standardized products.

Also, the process is time-consuming, requiring several technical skills.

Standard cost or Normal cost

- Normal costing is a method used to calculate the cost of a product by incorporating actual direct costs and estimated overhead costs.

- Standard costing involves estimating the cost of a production plan based on historical data and industry standards. It serves as a benchmark to compare against the actual costs incurred during production.

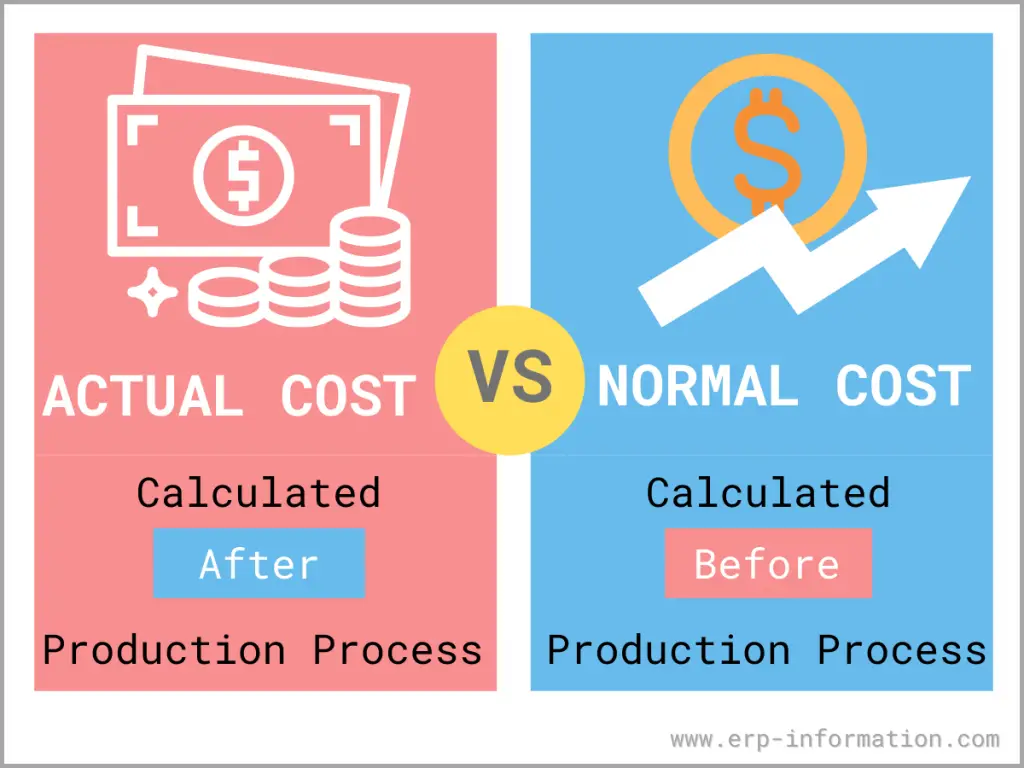

Standard cost vs Actual cost

| Standard Cost | Actual Cost |

| The cost is calculated before the production process. | The cost is calculated after the production process. |

| It includes direct costs and indirect costs. | It consists of the costs of the production process in real time. That means AC includes the costs, like any variations in labor charges and raw material prices. |

| Costs update once in a while | With this, the costs of the product update for each batch after calculating the actual expenses. |

| It assumes the cost of production. | It takes the actual expenses of each batch. |

FAQs

What is the total fixed cost?

Total fixed costs also called direct costs, are all the expenses directly associated with a project that you cannot avoid (recurring costs) or allocated in whole or in part to more than one cost object.

Total fixed costs are future cash expenditures for rent, utilities, debt service, insurance premiums, etc. Fixed costs do not include operating expenses such as labor, materials, and supplies.

For example, an organization might claim 1 million dollars in revenue per year, but $50% or $500,000 is committed to cover overhead/fixed expense items that cannot achieve the goal of generating revenue.

What are the disadvantages of actual costing?

Actual costing is disadvantageous because it takes longer to calculate and can be more expensive to implement.

In actual costing, the direct materials, direct labor, and overhead costs incurred in producing a product or service are assigned to that product or service. This approach is more accurate than allocation-based methods, but it’s also more time-consuming and costly to implement because of the need to track actual costs.

What is cost variance?

Cost variance is the difference between what was actually spent and what was planned or budgeted for a project or activity. This measure is essential for cost management, helping businesses see if they are staying within their budget or overspending.

Favorable Variance: When the actual cost is less than the budgeted cost.

Unfavorable Variance: When the actual cost exceeds the budgeted cost.

Conclusion

Mastering the concept of actual cost and its various elements empowers businesses to stay competitive and financially sound. By regularly monitoring and analyzing actual costs, companies can optimize their resource allocation, enhance profitability, and achieve their financial goals.