While many are familiar with Actual Cost, Planned Cost often gets less attention. Understanding the disparity between these costs holds substantial weight in shaping business strategies.

Planned Cost entails meticulous forecasting, encompassing all expenses linked to product manufacturing in advance. This distinction from Actual Cost, which reflects the realized expenditure, influences pivotal business decisions.

By comprehending these cost variants, businesses can refine budgeting, enhance cost efficiency, and fine-tune production strategies to align with forecasted expenses.

Knowing the difference between these two types of costs can help you make better decisions for your business. Read on to know more.

The post will disclose the definition and principles of planned cost. It also discusses the earned value management system and the difference between planned and actual costs.

Calculate Actual Cost Using Our Actual Cost Calculator Online

Definition

Planned cost is the estimated cost of a particular product. It is determined based on historical data of that product before manufacturing the specific product.

It is the total amount of money you expect to spend when creating or manufacturing that product. It includes components like direct raw material charges and direct labor charges.

Why Does It Matter?

- Budgeting: Knowing your planned cost helps you create a budget. It’s like figuring out how much you need to bake a batch of cookies for your product.

- Profit: By understanding your costs, you can set a price for your product that lets you make a profit. Think of it as deciding how much to sell each cookie for to earn some extra money.

- Success: Keeping your planned costs in check ensures your product is financially viable. If costs are too high, you might not make money, and that’s no good!

Planned cost principles

While estimating the cost, you need to follow certain principles. They are listed below.

- Must know the industry and market well: Understanding the industry of the product you are estimating is key. Also, it is equally important to know the market value of that product.

- Understand the estimating techniques: For more accurate estimates, explore various techniques like plus-minus tolerance, bottom-up, top-down, etc., and select the one that suits your business best.

- Use the suitable tools: Estimating tools help you improve the accuracy by 30%.

- Study the historical data and management review: They allow you to cross-check your estimation and help reach business standards.

Planned cost vs Actual cost

Before talking about the difference, we must know the actual cost.

The actual cost is the amount spent on a product for its production. That includes labor costs, delivery charges, and indirect expenses.

Learn more about Actual Cost.

So, let us see what sets them apart.

| Planned cost | Actual cost |

| It determines before producing a particular product. | It determines after producing that specific product. |

| Its calculation includes only direct costs like labor and raw material costs. | Its calculation includes direct, indirect, fixed, variable, and sunken costs. |

| It is an assumption. | It is the exact amount spent. |

Why does actual cost differ from planned cost?

There are a few reasons the actual cost can differ from the planned cost:

- Changes in market conditions (e.g., prices for materials or labor could increase)

- Unexpected events that lead to higher costs (e.g., a natural disaster that damages a factory)

- Inaccurate estimates at the time of planning

Earned value management system

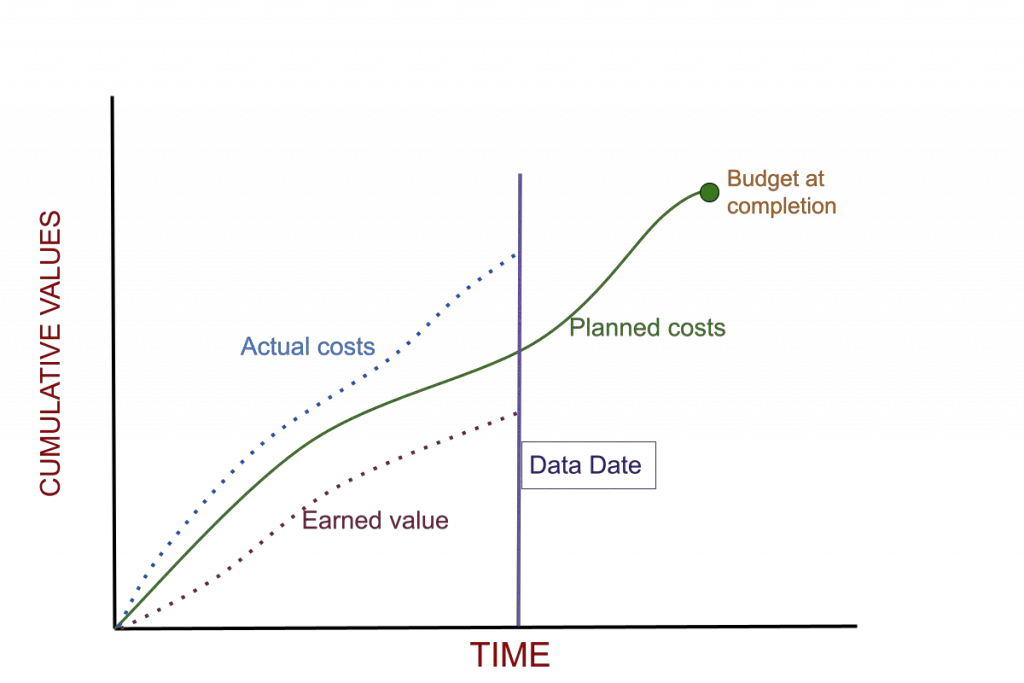

Earned Value Management System (EVMS) is a project management method that uses actual progress and budget costs to measure the performance of a project against its planned budget and timeline.

EVMS combines earned value techniques with data from other cost and schedule management systems to provide an integrated, comprehensive view of project performance.

As a result, it allows for more accurate forecasting of future performance, enabling organizations to identify potential problems better before they occur.

Using EVMS, organizations can improve their project success rate and reduce the costs associated with wasted time and resources.

In other words, EVMS is a measuring process for a project at any given time, integrated with a cost baseline and schedule baseline.

The earned value management system contains three elements. They are Planned Value, Earned Value, and Actual cost.

- Planned value: It is the cost or budget reserved to complete the work in a given time. It is also called Budgeted Cost for Work Scheduled (BCWS)

- Earned value: It is the value of completed tasks to date. It is also called the Budgeted Cost of Work Performed (BCWP)

- Actual cost: The total cost you have spent on a project or work. It is also called as Actual Cost of Work Performed (ACWP)

It is called favorable variance if the actual cost is less than the planned cost. Conversely, if the actual cost is greater, it is an unfavorable variance.

Planned Value vs Earned Value vs Actual Cost

| Planned value (PV) | Earned value (EV) | Actual cost (AC) |

| It is an estimate of the anticipated cost for a project based on a predetermined budget and timeline. | It measures work completed within the same predetermined budget and timeline. | It measures how much amount was spent on a project, regardless of whether it matched the original plan. |

| It provides an estimation of costs. | It offers insight into the progress made against that plan. | It gives a measurement of actual expenditure. |

FAQs

What is the difference between planned cost and budget?

A budget is the amount of money readily available to spend on products or projects over a while. Generally, the budget is set by the customer.

However, the planned cost is the estimated cost to produce the final product or complete a project. The manufacturer or vendor forecasts it.

A budget is for a shorter period, whereas a planned cost can be for the long term.

A budget considers all indirect and direct costs, but a planned cost only covers the direct costs.

How can you reduce your product’s planned cost?

You need to understand the factors on which the planned cost depends. They are as follows.

Raw material costs: You can reduce them by choosing the right supplier, negotiating the price, and using an alternative raw material.

Labor costs: By automating the production process, you can reduce labor costs.

Overhead costs: Improve your manufacturing process to reduce overhead expenses like electricity bills, water charges, etc.

You need to optimize your production process and improve efficiency to reduce planned costs.

Conclusion

Knowing the difference between planned and actual costs can help you make better decisions for your business.

For example, the estimated cost of a product, the Planned Cost, is determined based on historical data of that product before the manufacturing of the specific product.

The actual cost is the amount spent on a product for production, including labor costs, delivery charges, and indirect expenses.