As businesses grow and take on more responsibility for the environment, many are implementing internal carbon pricing to reduce their emissions. But what is this system, and how can it help your business become sustainably-minded?

This blog post will explore the concept of internal carbon pricing in depth, including its importance, types, potential benefits, and tips for setting an internal carbon price. Read the post to learn more about this powerful tool that could help you generate long-term environmental change at your company.

You can calculate Greenhouse Heating using our free online calculators.

Evaluate your Carbon Emission using our Carbon Emission Calculator.

What is Internal Carbon Pricing?

Internal carbon pricing is an efficient strategy to evaluate companies’ greenhouse gas emissions and drive positive changes.

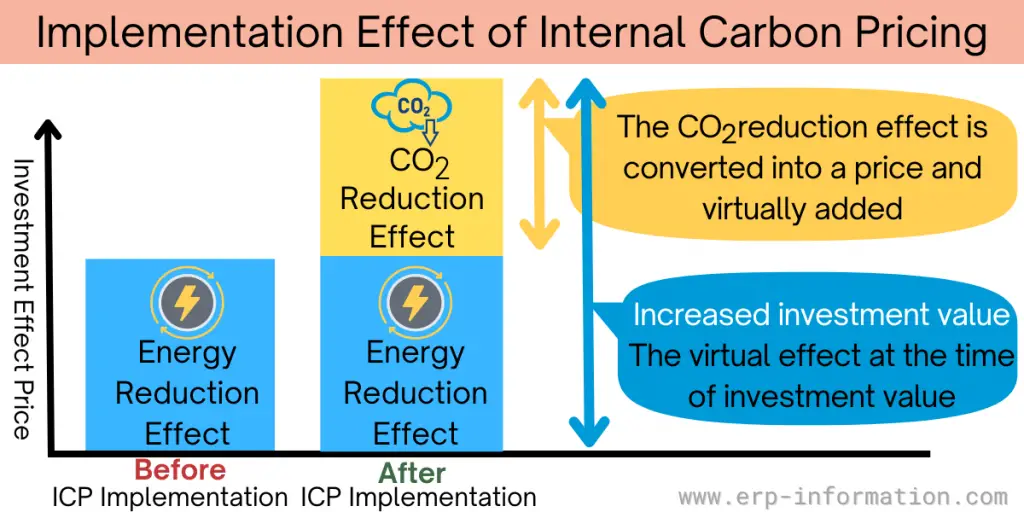

It enables businesses to attach a monetary value to their carbon footprint to assess the cost of greenhouse gas emissions. This approach allows companies to account for climate-related business risks and make informed decisions regarding investments in low-carbon solutions.

With the world moving towards a low-carbon economy, incorporating internal carbon pricing becomes crucial for businesses to remain competitive and stay ahead of regulations and policies to reduce carbon emissions.

Since the 1990s, industries like oil and gas, minerals and mining, and electric power have implemented internal carbon pricing to manage risks. As a result, businesses are better prepared for forthcoming policies limiting carbon emissions through internal pricing.

As per CDP (Carbon Disclosure Project) disclosures, in 2016, 1200 plus companies implemented internal carbon pricing or were getting ready to do so. Emerging economies like Brazil, India, China, and Mexico have seen the highest rise in such companies, even though most are located in Europe and North America.

Why is It Important for Businesses Today?

It is important for businesses to manage their greenhouse gas emissions, reduce risk and become more resilient to climate change.

By incorporating internal carbon pricing into their operations, companies can gain cost savings and an improved brand image and attract environmentally conscious consumers. It also helps them prepare for future policies restricting carbon emissions.

Finally, it has the potential to accelerate the transition towards a sustainable future by encouraging more businesses to take action on climate change. As such, internal carbon pricing is an increasingly important tool for companies to become more sustainable.

Types of Internal Carbon Pricing

An internal carbon fee

Implementing an internal carbon fee involves assigning a specific monetary value to each ton of carbon emissions, which should be easily understood within the organization. This fee generates a designated revenue or investment source to support the company’s initiatives to reduce emissions.

An implicit price

The concept of an implicit price refers to the expenses incurred by a company to lessen greenhouse gas emissions and adhere to government regulations. For example, the Amount spent on purchasing renewable energy by the company.

A shadow price

The shadow price is a hypothetical cost of carbon that can assist with long-term business planning and investment strategies. It allows a company to focus on investments that emit less carbon and be ready for upcoming regulations.

Organizations that Use ICP

Many organizations use internal carbon pricing for decision-making. Here we are listing three main organizations.

- Corporate industries: They use ICP to support corporate strategic investment decision-making and become low-carbon business models.

- Financial institutions: They use ICP to asses their project. They use it as a tool to assess their investment in new projects. That includes the measurement of the carbon footprint and support for low-carbon solutions.

- Governments: They use ICP as a tool for their procurement process related to carbon change impacts. They use three methods to set the internal carbon price.

- The social cost of carbon: It shows the value of damages caused by tons of GHG emissions globally. The approach of ICP is uncertain because it depends on predictions of economic conditions, population shifts, and the expenses for implementing adaptation measures.

- The marginal abatement cost: It calculates internal carbon price from meeting a national emission reduction target. This cost estimate is based on projected expenses for technologies that reduce emissions.

- The estimated future market values of emissions allowances: Sometimes, ICP may depend on the market prices of emission allowances.

In all three methods, as GHG emissions increase, cost also increases over time.

Benefits

Incentivizes emission reduction

By putting a price on carbon emissions, companies create a financial incentive for departments and employees to identify and implement measures to reduce their carbon footprint, which leads to lower overall emissions.

Encourages innovation

Internal carbon pricing can drive innovation by pushing businesses to use renewable resources and develop low-carbon technologies, products, and services. That helps companies stay ahead of the competition, meet consumer demand for sustainable solutions, and tap into new markets.

Risk management

Implementing internal carbon pricing helps businesses anticipate and prepare for future carbon regulations and taxes.

By incorporating these costs into their decision-making processes, companies can better manage risks, avoid stranded assets, and ensure long-term resilience in a low-carbon economy.

Aligns with sustainability goals

Internal carbon pricing can help companies meet their sustainability and Corporate Social Responsibility (CSR) goals.

By quantifying the cost of emissions, businesses can track their progress toward reducing their environmental impact and demonstrate their commitment to stakeholders.

Improved reputation and investor relations

Companies that adopt internal carbon pricing signal their commitment to addressing climate change, which can improve their reputation among customers, investors, and other stakeholders.

Investors increasingly consider companies’ environmental performance when making investment decisions, and businesses with robust carbon management strategies can attract more sustainable investment.

CDP interactive map explores worldwide carbon pricing.

Tips for Setting an Internal Carbon Price

Setting an internal carbon price involves steps that help businesses establish a value for their greenhouse gas (GHG) emissions and incorporate this value into their decision-making processes. Here is a detailed guide on how to set an internal carbon price:

Establish the rationale

Clearly define the reasons for implementing internal carbon pricing, whether it’s to manage risks, align with sustainability goals, reduce emissions, or prepare for potential future regulations.

Measure and calculate the carbon impact

Start by calculating how much your company emits and the associated environmental costs.

Conduct a comprehensive GHG emissions inventory following established protocols like the Greenhouse Gas Protocol to determine your organization’s carbon footprint.

This involves measuring emissions from direct sources (Scope 1), indirect emissions from purchased electricity (Scope 2), and other indirect emissions from the value chain (Scope 3).

Establish a reduction target

Set a goal for how much you want to reduce your emissions.

Secure leadership buy-in

Engage top management and key stakeholders in discussions about internal carbon pricing, highlighting the benefits and potential impact on the organization’s long-term resilience and competitiveness.

Determine the pricing approach

Choose the appropriate internal carbon pricing method for your organization. Two common approaches are:

- Shadow pricing: Assigning a hypothetical cost to emissions without actually transferring funds, used for evaluating projects and investments.

- Carbon fee or tax: Implementing an actual monetary charge on emissions, which can be collected and redistributed internally, e.g., to fund emission reduction projects.

Set the price

Establish the initial internal carbon price based on factors such as external carbon market prices, existing or anticipated regulatory costs, the social cost of carbon, and your organization’s specific risk tolerance and sustainability goals. Be prepared to adjust the price over time to reflect changing circumstances and objectives.

Integrate into decision-making

Incorporate the internal carbon price into financial models, investment appraisals, risk assessments, and budgetary processes.

Ensure that the carbon price is consistently applied across all departments and functions and that employees understand how it affects their decision-making.

Monitor and evaluate

Regularly review the effectiveness of your internal carbon pricing strategy. Measure its impact on emission reductions, innovation, risk management, and alignment with sustainability goals. Adjust the price or approach as needed to ensure it remains relevant and effective.

By following these steps, organizations can successfully establish and implement an internal carbon price that drives emission reductions, fosters innovation, and supports long-term resilience in a low-carbon economy.

Conclusion

Internal carbon pricing is a powerful business tool to reduce environmental impact. By setting an internal price on emissions, companies can better understand the true cost of their activities and make more informed decisions about how they use resources.

That will help companies become more sustainable while boosting their bottom line.

We hope the information covered in the post is beneficial for you.