What is the Bill discounting procedure? How does it work? These are two questions that we will answer in this blog post.

We will define the discounting procedure, advantages, disadvantages, and other details. Keep reading to learn more!

Evaluate discount using our online Discount Calculator

What is Discounting Procedure?

It is a financial tool that enables businesses to borrow money at a discount by selling their accounts receivable (invoices) to a third party for less than the face value of the invoices.

The discounting company charges a service fee, typically a percentage of the invoice amount. As a result, the discounting procedure can be an attractive option for short-term financing for businesses with strong customer relationships and good credit.

One of the advantages of the discounting procedure is that it offers a flexible repayment schedule.

Businesses can choose to repay the loan as soon as they receive payment from their customers or extend the repayment period for a longer term. This flexibility can be helpful for businesses that have seasonal or variable cash flow.

Another advantage of the discounting procedure is that it can finance one-time projects or expenses. This can be helpful for businesses that need financing for equipment purchases, inventory, or other one-time costs.

The main downside of the discounting procedure is the fees charged by discounting companies. These fees can add up, and they are typically paid upfront.

The costs associated with the discounting procedure can harden the bottom line for businesses with tight profit margins.

Bill Discounting Formula

Technically discounting procedure is when the vendor sells the bill to the addressed company for a lesser value than the actual invoice amount before the due date.

The difference is made in the amount paid, and the discounting company earns the bill value. The fee will vary based on the time before the due date and the expected risk.

Invoice Discounting = Bill amount – Amount paid

Who will get benefit from the discounting procedure?

Both vendor and buyer will get benefit from the discounting procedure.

Because of the discounting procedure, the vendors will get the money as soon as possible, which helps them make more cash that can be further utilized for the business.

The vendor sells the goods to the purchaser and issues an invoice as agreed by both parties. The buyer verifies and acknowledges clearing the invoice before the agreed due date.

The seller then contacts the discounting company and scrutinizes the credibility of the seller and the validity of the submitted invoice.

Once it gains the confidence to proceed, the discounting company will release the cash to the seller with a negotiated margin that depends on several factors. Then, finally, the vendor gets the fund and uses it as per their choice.

With the arrival of the payment due date, the discounting company will produce the invoice to the buyer and collect the money for their transaction.

Even though discounting helps bring immediate cash to the sellers, it is expensive compared to bank overdrafts.

However, with several brokers and financial institutions encouraging this system, it is advantageous for the sellers to get cash in dire situations where other options are unavailable and uncertain.

Example of Discounting Procedure

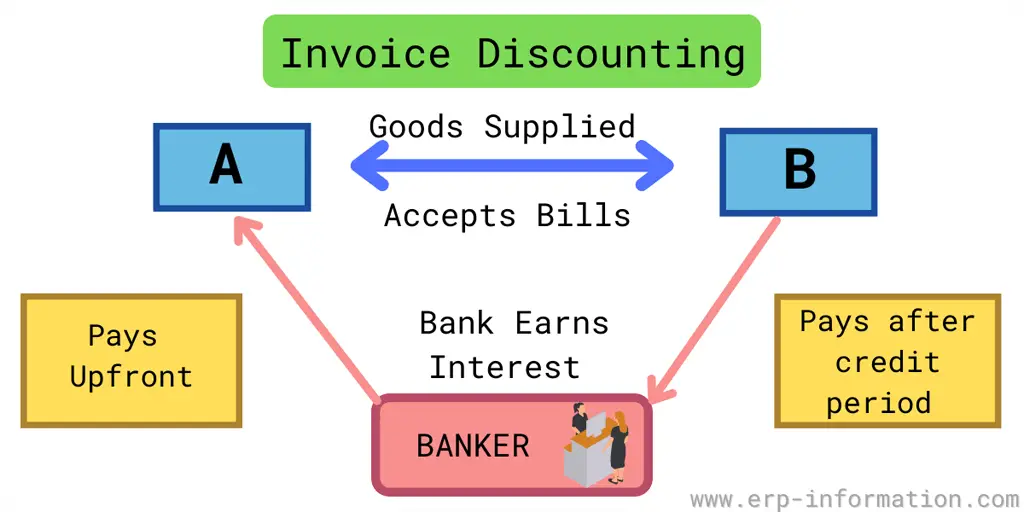

Assume that company A (vendor) sold its products to company B (buyer). As a result, company B gives Company A a letter of credit from the bank of 30 days.

If company A wants to get money from the bank before 30 days, the bank charges some interest rate from company A.

Assume that company A is supposed to get $100,000 after 30 days because of the bank’s interest of $5000. Company A receives $.95,000 in return from the bank. Company B deposits $.100,000 to the bank on the 30th day only.

Here, company A sold its products and got paid immediately, company B got the goods by not settling directly, and the bank earned a commission of $5000 on invoice discounting.

This process discounting procedure is called invoice discounting or Bill discounting.

Two ways of presenting the invoice

- With resource: The vendor’s bank verifies and checks all the documents and discount terms and then sends them to the buyer’s bank. Then the buyer’s bank does not check the other things and can claim to reimburse later on if any issue exists.

- Without resources: The vendor’s bank does not check any documents during the request for the payment, but the buyer’s bank checks all the records.

Advantages of Discounting

Boosts cash flow

As soon as an invoice is issued, you get cash immediately. This cash can be used to invest in the business. This way allows you to boost your cash flow and start your business.

Free ups locked cash

It avoids blocking money in customer invoices for a long time.

A quick way to get loans

It helps reduce the time the invoice takes to convert to cash. Once your invoice financing partner trusts you, you can automatically reduce the collection period of your invoices by submitting those invoices for invoice discounting.

Not required assets

There is no need to submit your company assets to the bank. The banks only require the account receivables as surety.

Disadvantages of Discounting

Reduced profits

It reduces the profit on invoices that have been financed. That is a short-term service. The discount covers interest charges, administrative charges, and maintenance charges.

The percentage of discounts also differs from one banker to another. So the vendor who sells the goods has to lose some portion of the bill value.

Limited discount bills

All bills can not be discounted. Invoice discounting is usually offered only for commercial accounts because of the risk involved for the banker.

Why do we need discounting?

We may need discounting because, by considering the time value of money, the value of a dollar today is more than the value of the dollar tomorrow. So discounting is essential in evaluating future cash flow.

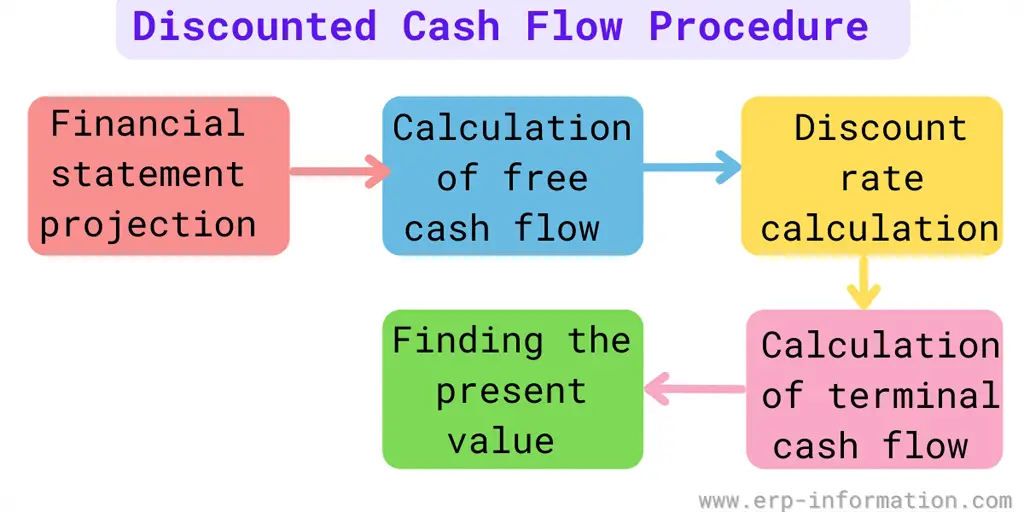

What is Discounted Cash Flow?

Discounted cash flow is an evaluation technique that allows you to evaluate the value of an investment drawn on its expected cash flow.

Analysis of discounted cash flow helps determine the value of today’s financing based on forecasting how much money it will create in the future.

Calculation of discounted cash flow includes the following procedures.

- Calculation of financial statement procedure

- Analysis of free cash flow

- Calculation of discount rate

- The measure of terminal cash flow

- Finding the final value

Conclusion

If you’re interested in using the Discounting procedure, you’ll need to find Discounting companies willing to purchase your invoices at a discount.

It is not without its risks; however, one of the most significant risks is that you may not be able to find the discounting company willing to discount the sale of your accounts receivable (invoices). Additionally, it can hurt your credit score if it’s not used correctly.

Hoping you found this information helpful!