Accounts payable automation is an organization’s most important tool to improve efficiency. With automated technology, businesses can streamline processes, improve record-keeping for audit purposes, increase cash flow visibility, and maintain the business’s solvency.

The benefits of implementing Accounts Payable Automation Software are vast – reduced manual errors, improved cost management by reducing bulk costs associated with paper processing, and customizing payment plans to meet supplier terms resulting in fewer late payments.

This article will look at the ten best Accounts Payable Automation software on the market today, so you can decide which solution is right for your organization.

What is Accounts Payable Automation?

Account payable automation is automating the Accounts payable department’s workload. Automation can be used in Accounts payable to speed up and improve efficiency in many areas, including:

- Vendor management

- Payment processing

- Expense management

- Reporting

Common features of accounts payable automation software

Invoice capture and processing

This feature automates the process of capturing and extracting data from invoices, regardless of their format (paper, PDF, email, etc.). That can help to reduce errors and improve efficiency.

Three-way purchase order matching

This feature automatically matches invoices, purchase orders, and receiving reports, which can help to prevent overpayments and fraudulent payments.

Workflow automation

It allows you to automate invoice approval processes, routing them to the appropriate stakeholders for review and approval based on predefined rules and workflows. That can help to speed up payments and reduce bottlenecks.

Vendor management

This feature helps you to centralize and manage vendor information, including contact information, payment terms, and tax information. This can help to improve communication with vendors and streamline the payment process.

Payment processing

It allows you to make electronic payments to vendors directly from the software. This can reduce manual steps and improve efficiency.

Reporting and analytics

This feature provides insights into your accounts payable data, such as invoice processing times, payment terms, and vendor spending. This information can help you identify improvement areas and make better financial decisions.

The exact features of accounts payable automation software can vary depending on the product and vendor. Therefore, it’s important to carefully evaluate each option to ensure it meets your business’s unique needs.

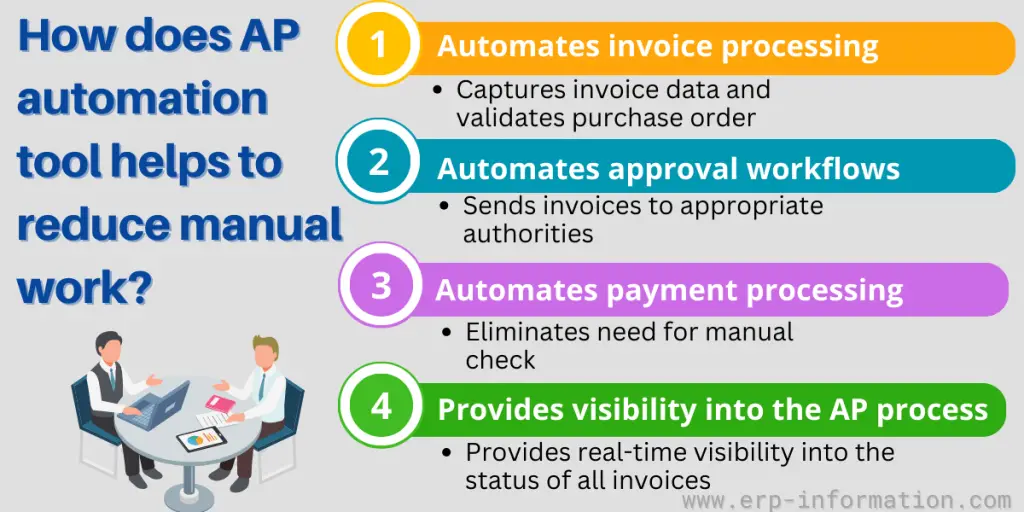

How does AP automation tool help to reduce manual work?

Accounts payable automation software reduces manual work in a number of ways including:

Automating invoice processing

Accounts payable automation software captures invoice data from a variety of sources, including paper, PDF, and email.

This data can then be automatically validated and matched to purchase orders and receiving reports. This process eliminates the need for manual data entry and validation, which can be time-consuming and error-prone.

Automating approval workflows

The software automatically sends invoices to the appropriate managers or departments for approval, based on factors such as the amount of the invoice, the type of purchase, or the vendor. That saves a lot of time and hassle and helps to confirm that invoices are approved and paid on time.

Automating payment processing

Accounts payable automation software makes payments to vendors based on approved invoices. That eliminates the need for manual check writing and mailing, which can be time-consuming and inefficient.

Providing visibility into the accounts payable process

The software provides real-time clarity into the status of all invoices, including their approval status, due date, and payment status. This visibility helps companies to identify and eliminate unnecessary manual steps in the accounts payable process.

Here is the list of software

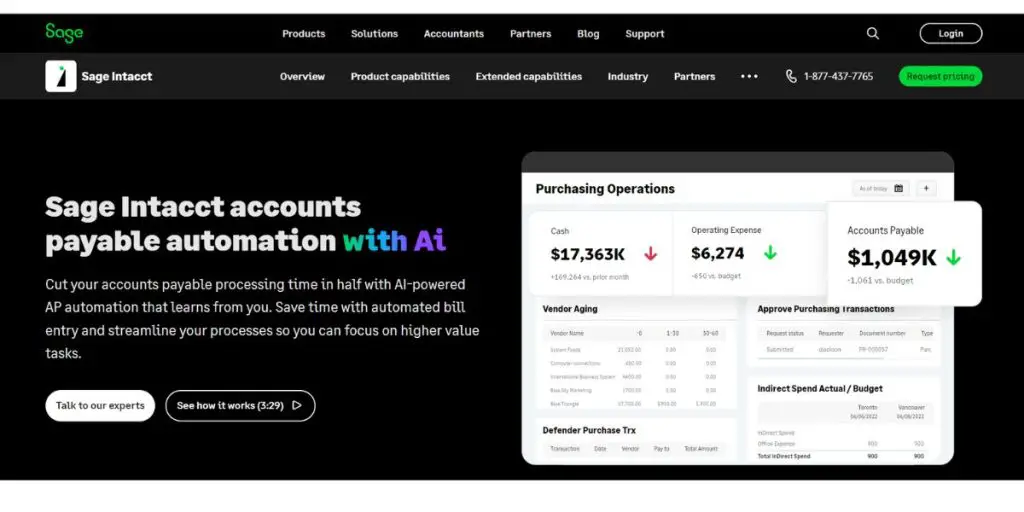

1. Sage Intacct

It is a cloud-based software and helps to automate the accounts payable process. It provides real-time visibility trough-out the accounts payable workflow. The software is more suitable for small and mid-sized businesses.

Sage Intacct enhances your accounts payable process with AI-powered automation, doubling productivity and reducing manual data entry time.

Sage AI improves efficiency by learning from usage, automatically extracting details from AP bills and generating drafts for approval.

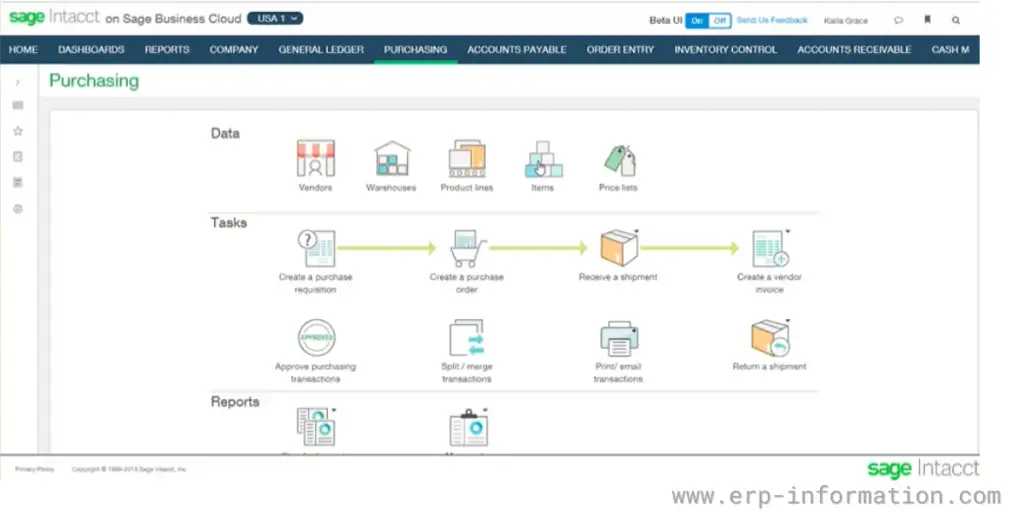

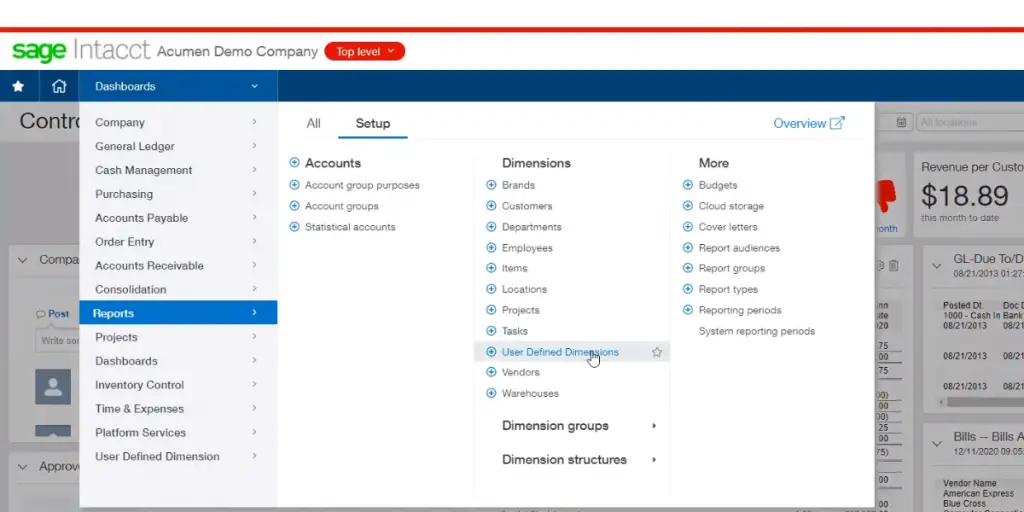

Features

- AP automation

- General ledger

- Cash management

- Order management

- Spend management

- Purchasing

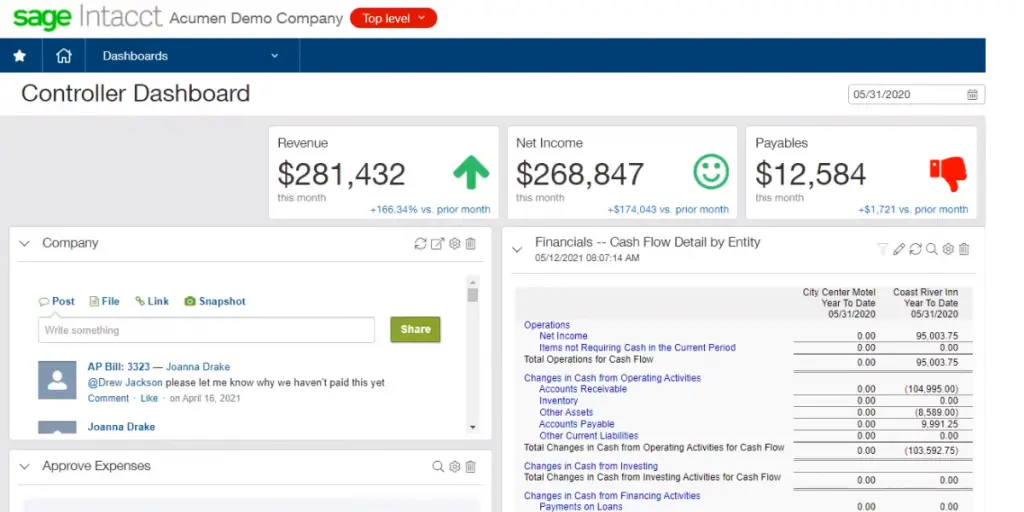

Some screenshots of Sage Intacct

Pricing

Pricing details are not disclosed on the official website. Instead, you need to request pricing by filling out a form.

Likes

Likes

- Enhances the accounts payable processing time

- Eliminates unwanted, inefficient workflows

- With the help of the ‘vendor payments’ feature, you can connect all your vendors, banks, and payment platforms.

- You can have visibility and traceability with centralized access for billing, approvals, and payment status.

- It allows you to pay your vendors with any payment method like checks, virtual cards, or ACH.

Dislikes

Dislikes

- Some users find the reporting options confusing

- There is no such option to integrate supportive documentation; you have to upload all manually

- It takes time to navigate

- It has some limited options in the PO module

- The payment application has sync errors

- Dashboard features are not available for the basic plan

- Requires re-login after 4 hours of inactivity.

- Not optimized for mobile devices.

- Limited customization options.

- Printing P&L reports is somewhat challenging. Statistical accounts are difficult to set up.

Supported industries

- Accountants and CPA Firms

- Biotech and Life Sciences

- Construction and Real Estate

- Financial Services

- Healthcare

- Retail

- Nonprofit

- Professional service

- Hospitality

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported languages | English |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep), Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.3 out of 5 (456+reviews) G2: 4.3 out of 5 (3190+reviews) |

User opinion

Sage Intacct streamlines accounts payable by eliminating inefficient workflows and connecting vendors, banks, and payment platforms. It offers centralized access for billing, approvals, and various payment methods.

However, it has some confusing reporting options, manual documentation uploads, slow navigation, limited PO module options, and no mobile optimization.

2. Lightyear

Lightyear is the world’s fastest accounts payable automation software. It is both user-friendly and comprehensive. Lightyear offers many features to help businesses manage purchases, invoices, payments, and other financial processes.

In addition, it provides an intuitive interface that makes it easy to use, even for those not experienced in accounting or finance.

Features

- Creation and approval of purchase orders

- Goods received tracking/Automated book keeping

- Price checking

- 3-way matching

- Creation of PO and GRNs

- Data extractions

- Approvals workflow

- Mobile apps

- Accounting integrations

- Auto reconcile statements

- Bank verifications

- Intelligent data extraction

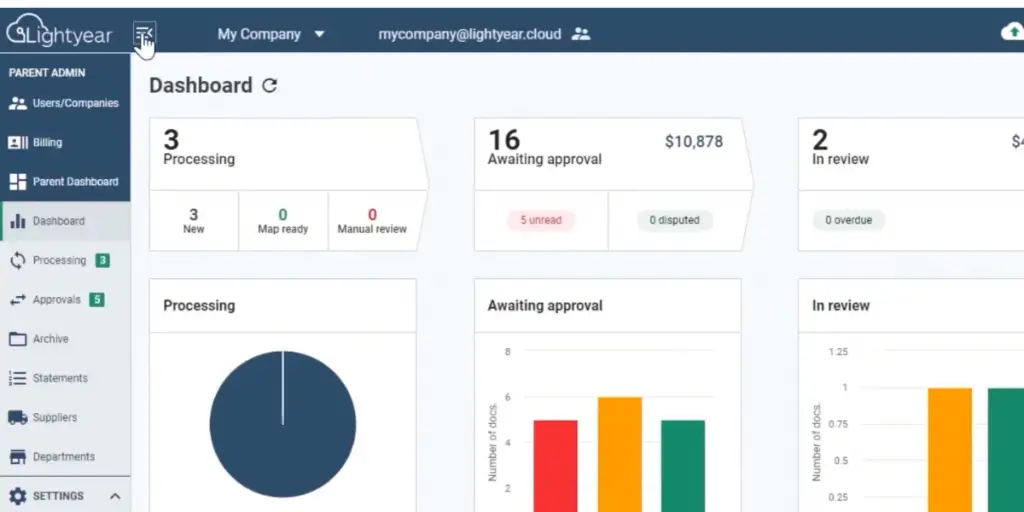

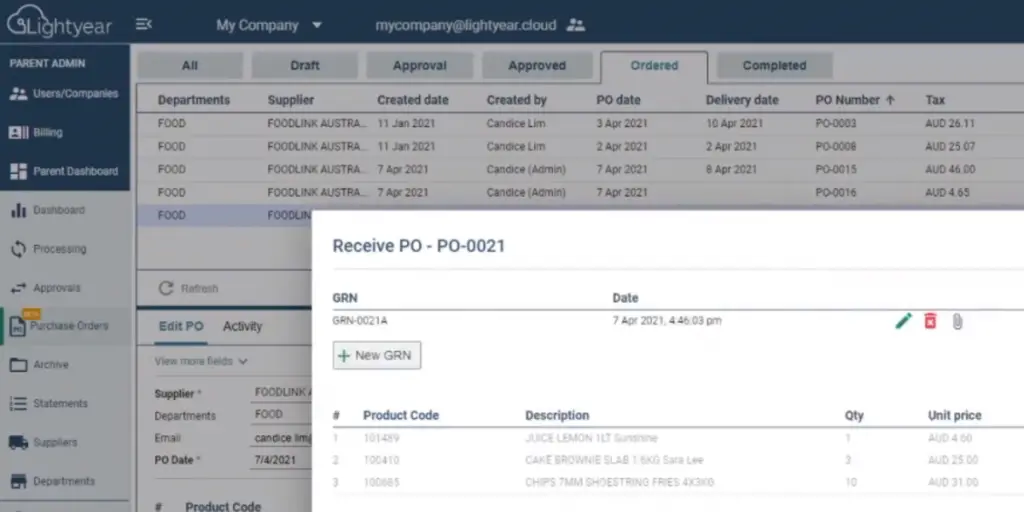

Some screenshots of Lightyear

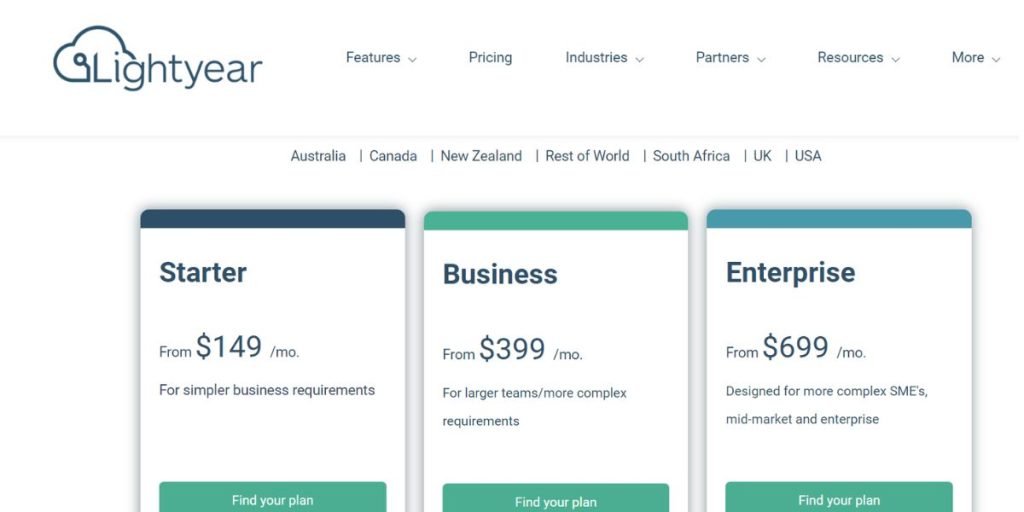

Pricing

It offers three types of pricing plan

- Starter – Starts from $149 per month

- Business – Starts from $399 per month

- Enterprise – Starts from $699 per month

Likes

Likes

- Provides all the required features for the AP automation process

- It provides a free trial

- Users can create an unlimited child account

- Zero installation fees

- Provides exemplary customer support (24/5 chat, phone, email)

Dislikes

Dislikes

- The starter plan does not offer purchase order, GRN, and 3-way matching

- You need to upgrade to the business plan to get the purchase order feature

- The mobile app doesn’t have all the features

- Sometimes, it becomes an unstable invoice causing re-entry

- Reading OCR code is not fast enough

- The loading speed can sometimes be slow

- Group consolidation features could use enhancement

- There’s no option to bulk upload historical invoices from the previous system.

Supported industries

- Education

- Hospitality

- Manufacturing

- Cannabis farms

- Automation for the Automotive Industry

- Construction

- Oil and gas energy

- Manufacturing

- Technologies

- Transport and logistics

- Life science and Biotics

- Franchises

- Aged care

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported languages | English |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep), Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.9 out of 5 (153+reviews) G2: 5 out of 5 (15+reviews) |

User opinion

Lightyear is a AP automation tool with a free trial, unlimited child accounts, and zero installation fees. However, the starter plan lacks certain features like purchase order management, requiring a business plan upgrade.

The mobile app has limited functionalities, and issues like slow OCR reading, occasional unstable invoices, and no bulk upload for historical invoices exist.

3. Tipalti

Tipalti is a cloud-based AP automation software that helps businesses pay their suppliers faster and more efficiently.

With Tipalti, businesses can streamline the entire AP process, from invoice creation and approval to payment. Tipalti also strongly focuses on compliance, ensuring that all payments are made following regulations.

Features

- Supplier management

- Invoice management

- Purchase order matching

- Payment remittance

- Payment reconciliation

- Partner management

- Fraud detection

- Global payments

- Self-billing module

- Currency management

- 2 and 3 way PO matching

- Corporate card

- Tax compliance

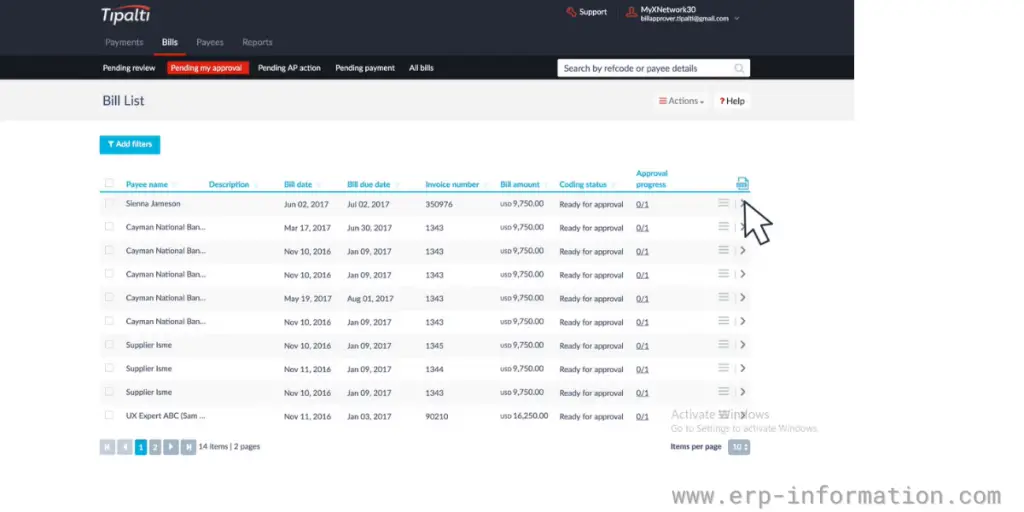

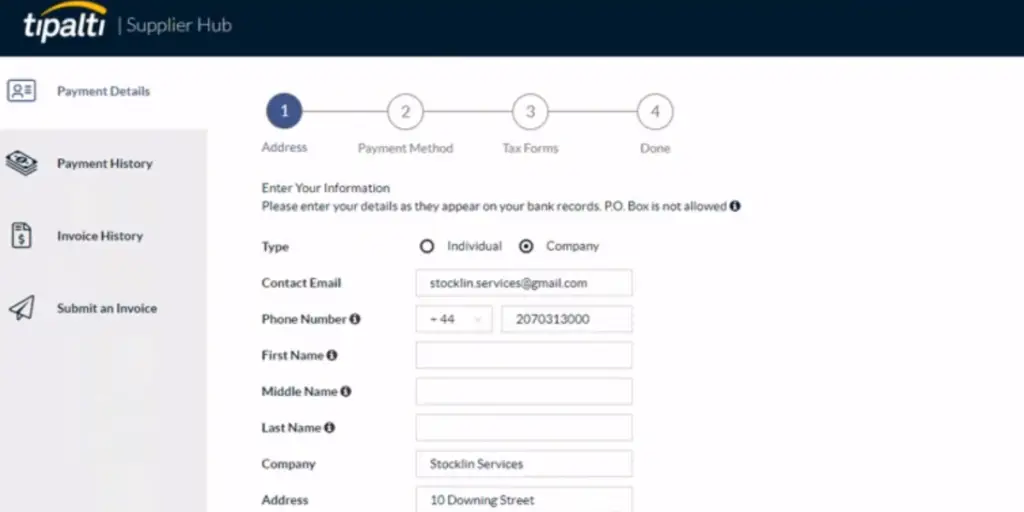

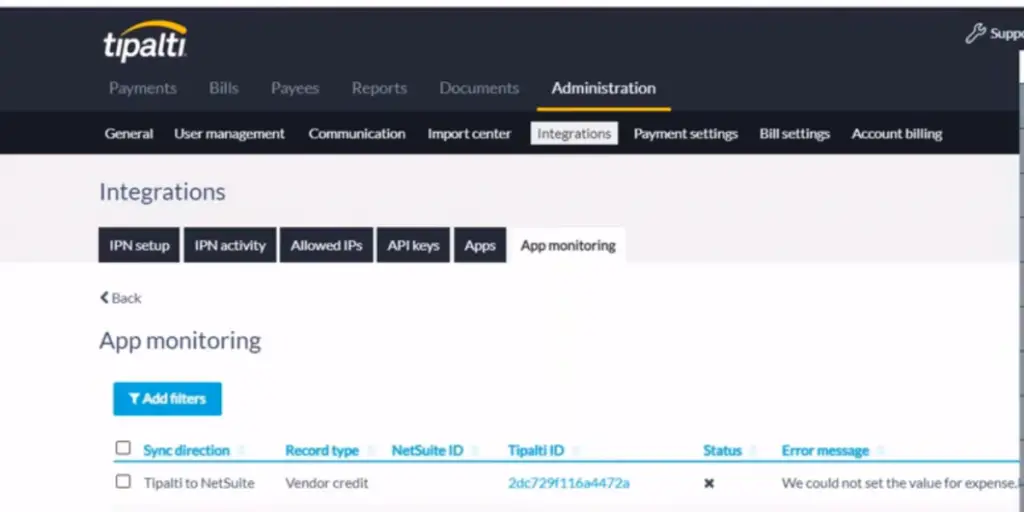

Screenshots of Tipalti

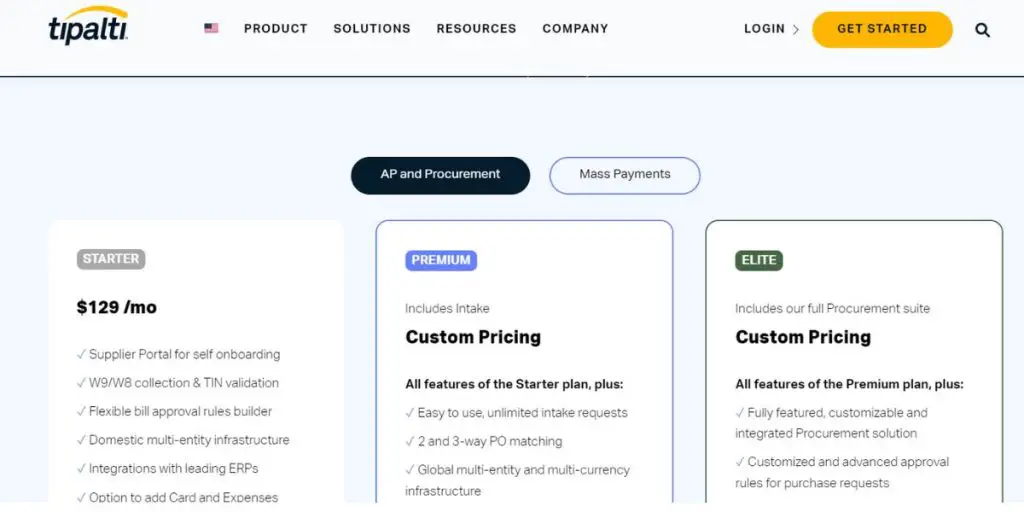

Pricing

- Starter – It starts from $129/month

- Premium And Elite – for this plan you need to contact the vendor directly.

Likes

Likes

- Offers a feature for purchase order management

- Reduces payment errors

- Reduces accounts payables workloads

- Provides real-time insights

Dislikes

Dislikes

- Mobile apps and free trials are not available

- The option to download a list of payees by category is not available at this time.

- Tax formats filling form available only in English

- When you have to pay multiple invoices from the same vendor, they cannot be selected all at once

Supported industries

- Advertising Technology

- Affiliate & Influencer Networks

- Business Services

- E-commerce & Retail

- Healthcare

- Marketplaces & Gig Economy

- Software & Technology

- Non-profits

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Mac, Windows, Linux, Android, iPhone, iPad |

| Supported languages | German, English, French, Italian, Japanese, Korean, Dutch, Portuguese, Russian, Spanish, Chinese (Simplified) |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep) |

| Training | In-person, Live Online, Webinars, Documentation |

| Customer ratings | Capterra: 4.6 out of 5 (132+reviews) G2: 4.5 out of 5 (224+reviews) |

User opinion

It offers real-time insights, enhancing financial decision-making. However, it lacks mobile apps and free trials, doesn’t support downloading payee lists by category, and only offers tax form filling in English. Additionally, it doesn’t allow batch selection for multiple invoices from the same vendor.

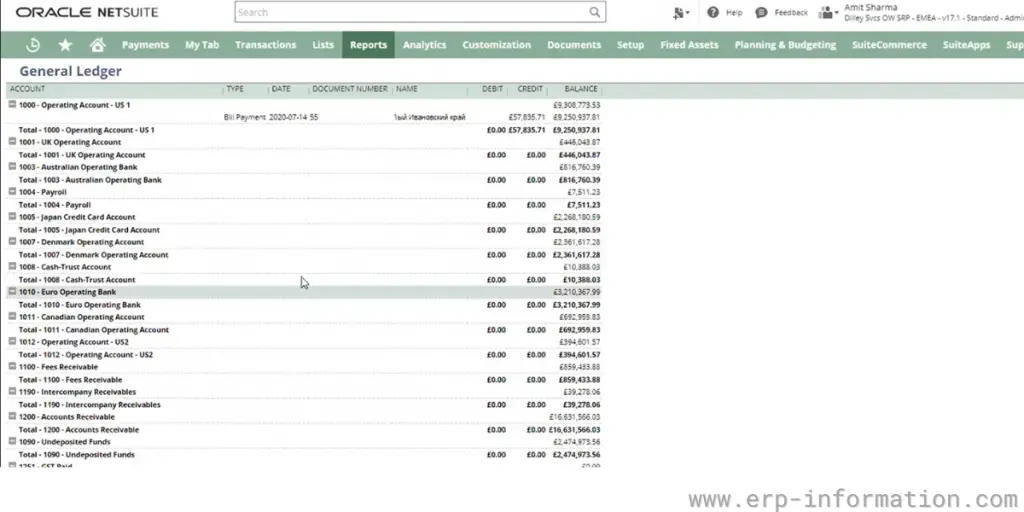

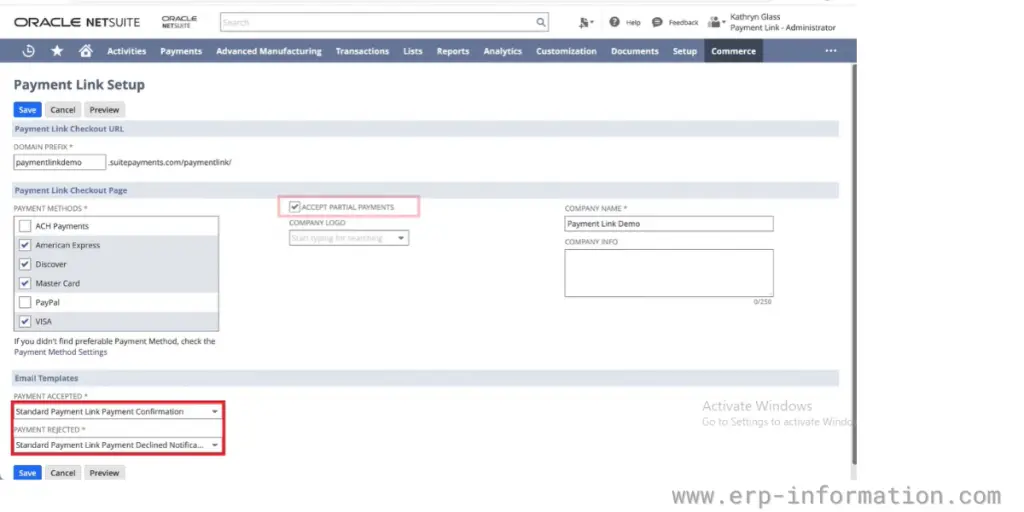

4. Oracle NetSuite

NetSuite is a cloud accounting software that helps businesses automate their accounts payable. In addition, NetSuite allows businesses to manage their finances, including invoicing, payments, and expenses. NetSuite also provides tools to help companies manage their cash flow and financial reporting.

It maintains detailed vendor records, manages purchase requests, and improves data accuracy by matching invoices to vendors and purchase orders automatically.

Features

- General ledger

- Cash management

- Automatic process of invoices

- Payment management

- Real-time insights into the accounting system

Some screenshots of NetSuite

Pricing

The vendor does not provide pricing details. Contact the vendor for more information.

Likes

Likes

- Helps to automate repetitive tasks

- You can access the software from anywhere

- It avoids duplication of data entry

- Provides real-time information and role-based dashboards

Dislikes

Dislikes

- No free trial

- Not suitable for small businesses

Supported industries

- Advertising & Digital

- Marketing Agencies

- Apparel, Footwear & Accessories

- Campus Stores

- Consulting

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Android, iPhone, iPad |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep), Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.1 out of 5 (1171+reviews) |

User opinion

Oracle NetSuite is a powerful tool that automates repetitive tasks and provides cloud-based access, preventing data entry duplication and offering real-time information with role-based dashboards.

While it lacks a free trial and isn’t ideal for small businesses, it is an excellent solution for larger enterprises seeking to enhance operational efficiency and data management.

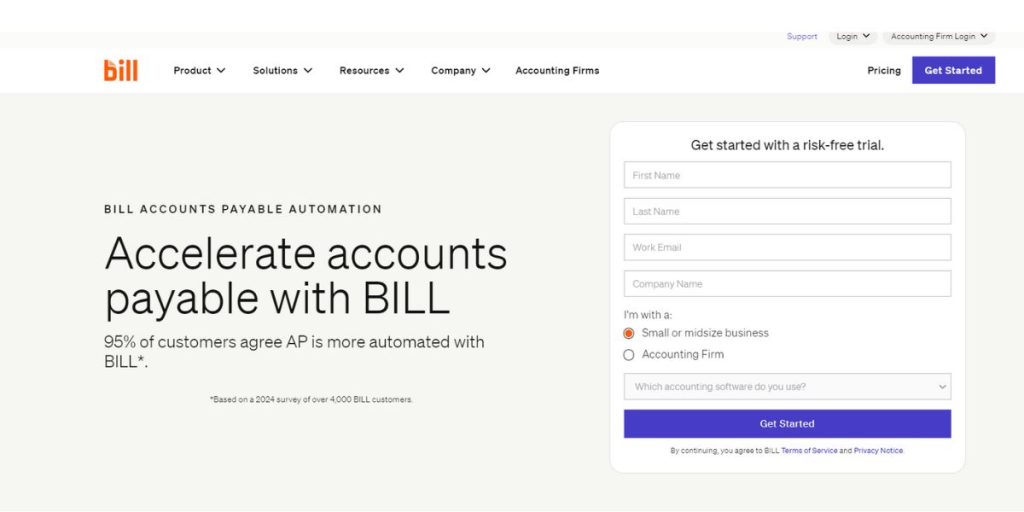

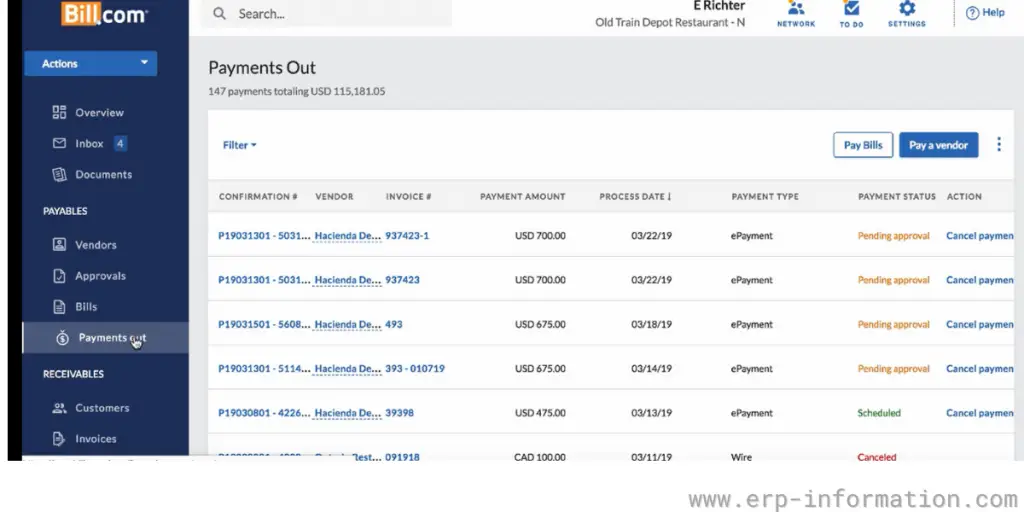

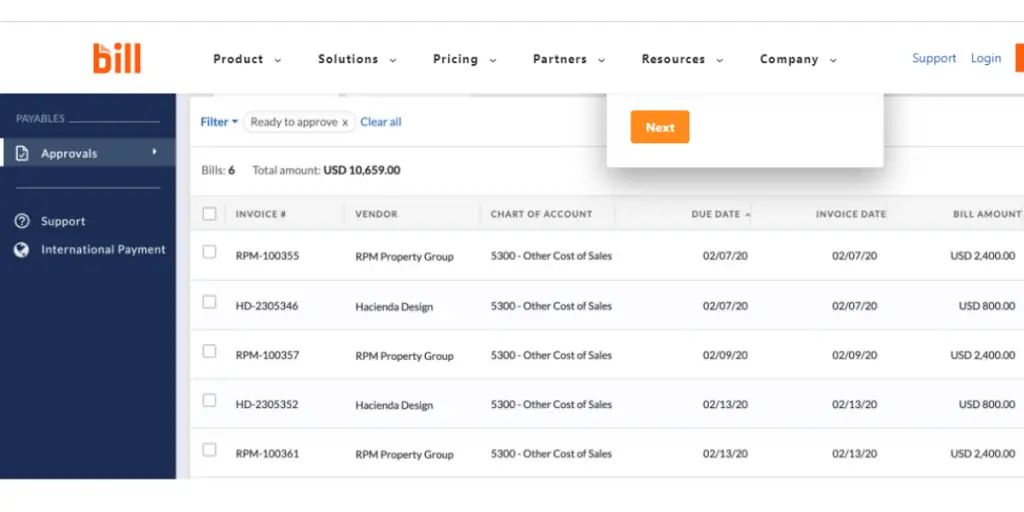

5. Bill.com

Bill.com is a software tool for automated accounts payable for small and mid-sized businesses. You can generate bills, pay bills, and send invoices with this software.

Features

- Payments

- Approvals

- Controls

- Invoicing

- API

- 360-degree vendor information

- Customer user roles

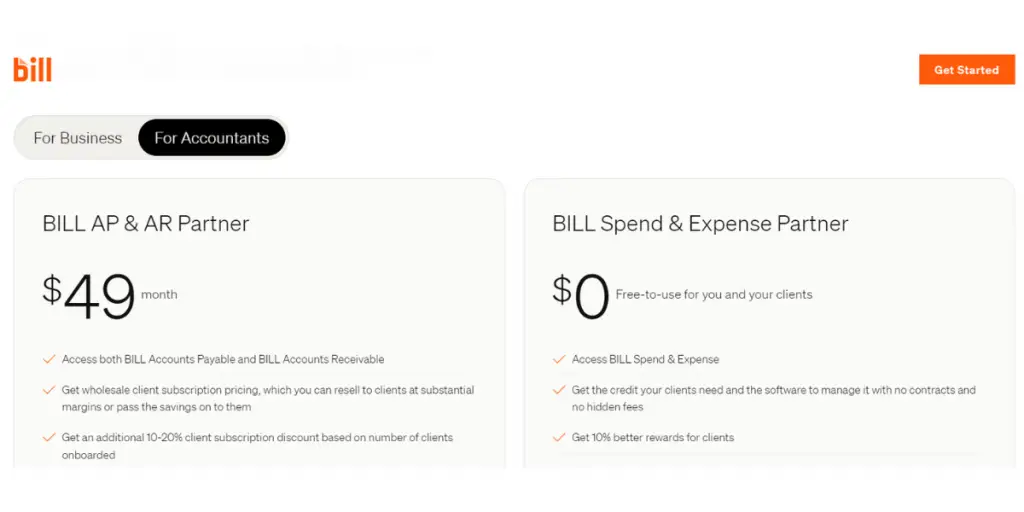

Some screenshots of Bill

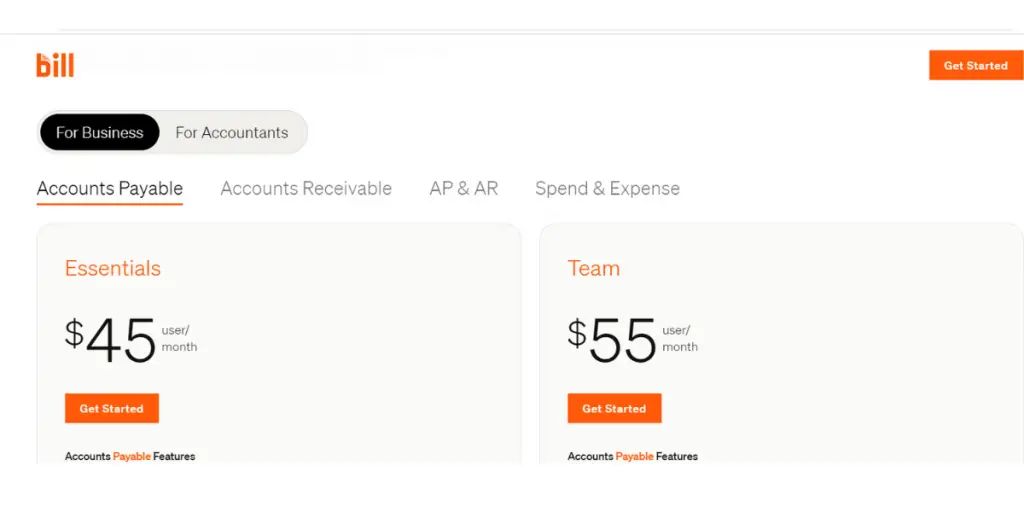

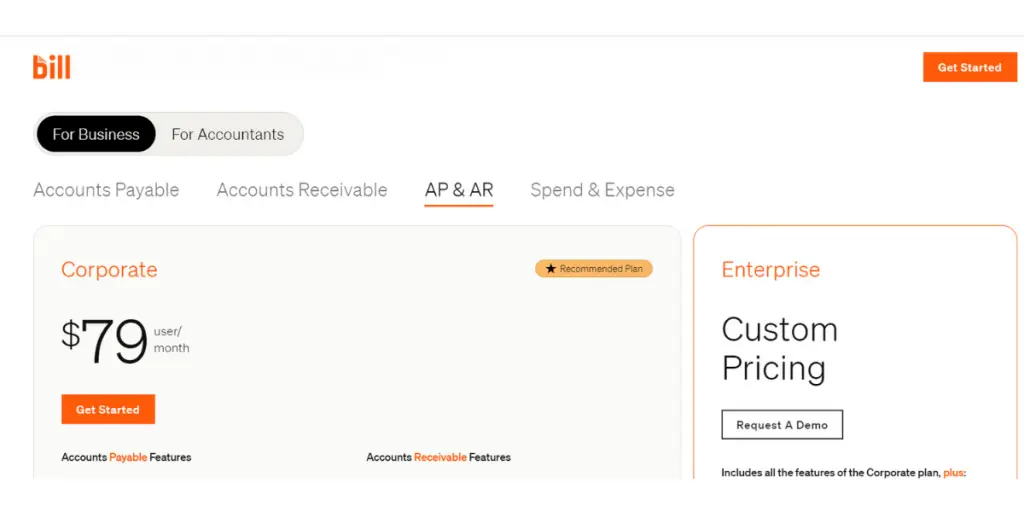

Pricing

It offers three different plans for businesses.

- Essential– It starts from $45/user/month

- Team- It starts from $55/user/month

- Corporate– It starts from $79/user/month

For accounting firms, it offers a cost of $49 per month.

Likes

Likes

- It provides unlimited data storage

- You can easily import invoices into bill.com

- Enhances your time by 50%

- It offers multiple payment options

- Provides sync between critical data like vendors, invoices, accounts

Dislikes

Dislikes

- Integration with limited accounting systems

- If you need integration with more accounting systems, you need to upgrade the pricing plan

- There is no way to turn off automatic pay reminders

- Scheduling one-off invoices for future dates is not possible.

Supported industries

- Accounting firms

- Hospitality

- Software & Technology

- Professional services

- Wealth management

- Education

- Healthcare

- Manufacturing

- Retail and E-commerce

- Non-profits

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Android, iPhone, iPad |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep), Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.2 out of 5 (439+reviews) G2: 4.4 out of 5 (1007+reviews) |

User opinion

It offers extensive data storage, simple invoice imports, and multiple payment methods, which greatly improves efficiency. It allows seamless data synchronization but needs an upgraded plan for more accounting system integrations. However, it doesn’t let users turn off automatic payment reminders or schedule single invoices for future dates.

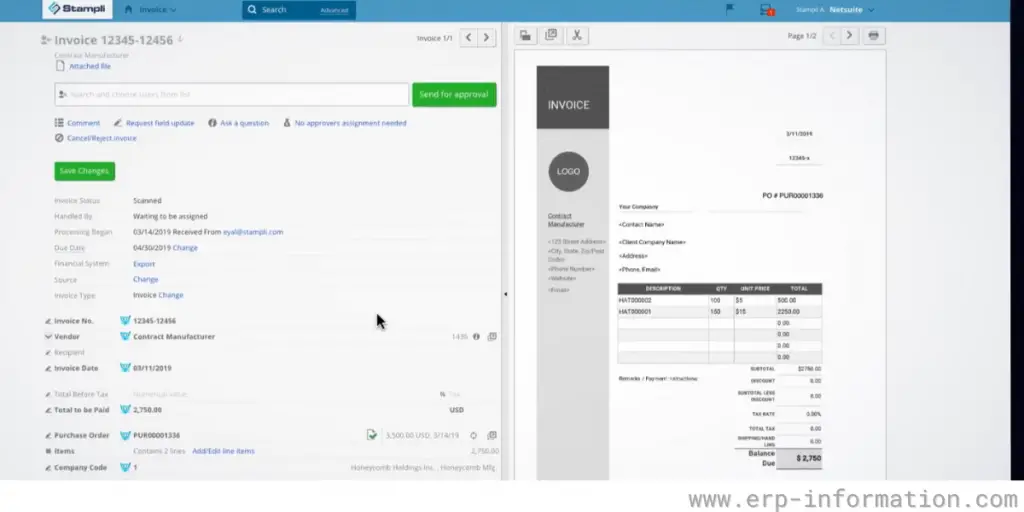

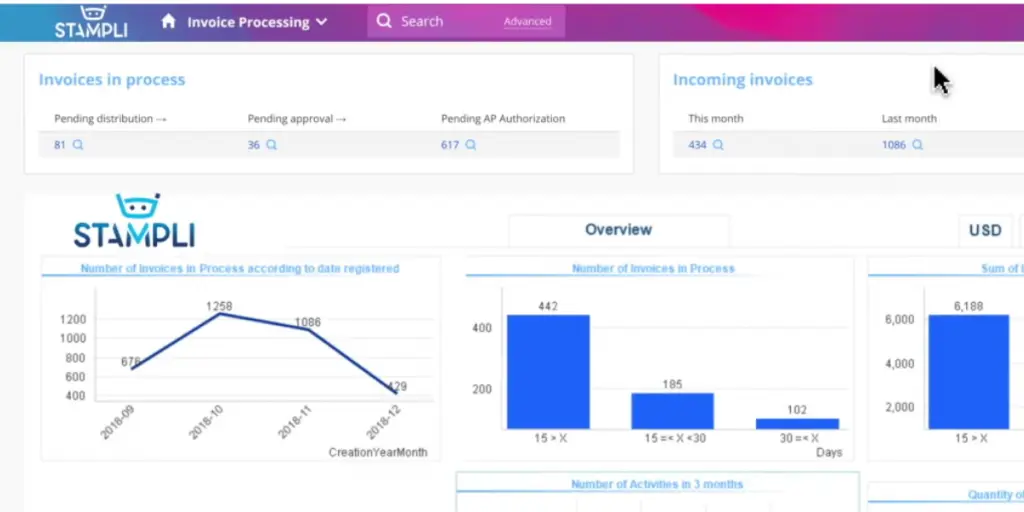

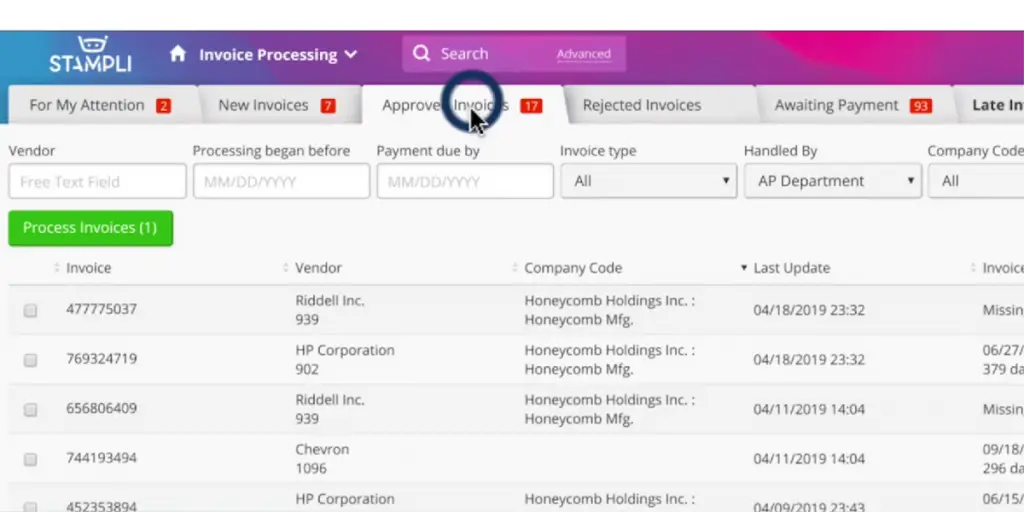

6. Stampli

Stampli is a cloud-based Accounts Payable automation software that helps businesses manage bill processing and track invoices. It offers smart, intuitive, and actionable AP automation.

Features

- Intelligent AP automation

- Accurate invoice capturing

- Keep pace with change.

- Scale for growth

- Intuitive dashboard

- Centralized collaboration

- Clear visibility of the AP automation process

- Automated communications

- Audit ready history

- Seamless integration

- Fast implementation

- GL table template

- PO support

- Vendor portal

Some screenshots of Stampli

Pricing

The vendor does not provide pricing details. Contact the vendor for more information.

Likes

Likes

- It helps the accounting department collaborate and communicate efficiently

- It allows you to access invoices anytime

- You can make payments in multiple ways, like cash, checks, ACH, and credit cards.

- You can work with the software from anywhere, on any device

Dislikes

Dislikes

- It is not customizable

- There is no 24/7 customer support

- The actual video is not shown in the demo

- No mobile apps

- Only one user can access a record at a time.

- Managing the credit card function is challenging.

Supported industries

- Agriculture

- Automotive

- Cannabis

- Oil & gas

- Media & Entertainment

- Professional service

- Health care

- Manufacturing

- Real estate

- Technology hardware & equipment

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Mac, Windows |

| Supported languages | English, Hebrew |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, Chat |

| Training | Live Online, Documentation, Videos |

| Customer ratings | Capterra: 4.2 out of 5 (12+reviews) G2: 4.7 out of 5 (1243+reviews) |

User opinion

It offers anytime access to invoices and supports diverse payment methods such as cash, checks, ACH, and credit cards. Users can operate the software from any device, ensuring flexibility.

However, it has some shortcomings: it’s not customizable, lacks round-the-clock customer support, and the demo does not include actual video footage.

Additionally, it does not offer mobile apps, limits record access to one user at a time, and poses challenges in managing the credit card function.

7. Avidxchange

Avidxchange is a comprehensive AP Automation software that helps businesses manage and streamline their AP processes. In addition, it provides a complete suite for procure-to-pay.

It helps you to connect a large number of supplier networks with an integrated ERP system. This automated workflow enables you to reduce admin work as well as paperwork.

Features

- Flexible, automated payments

- Invoice management

- Real-time analytics

- Matching and approvals

- Batch processing

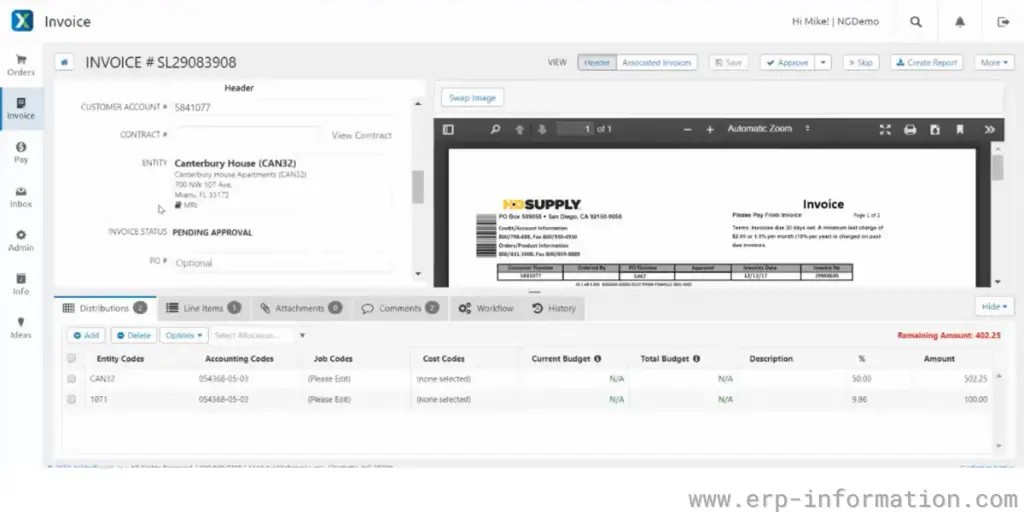

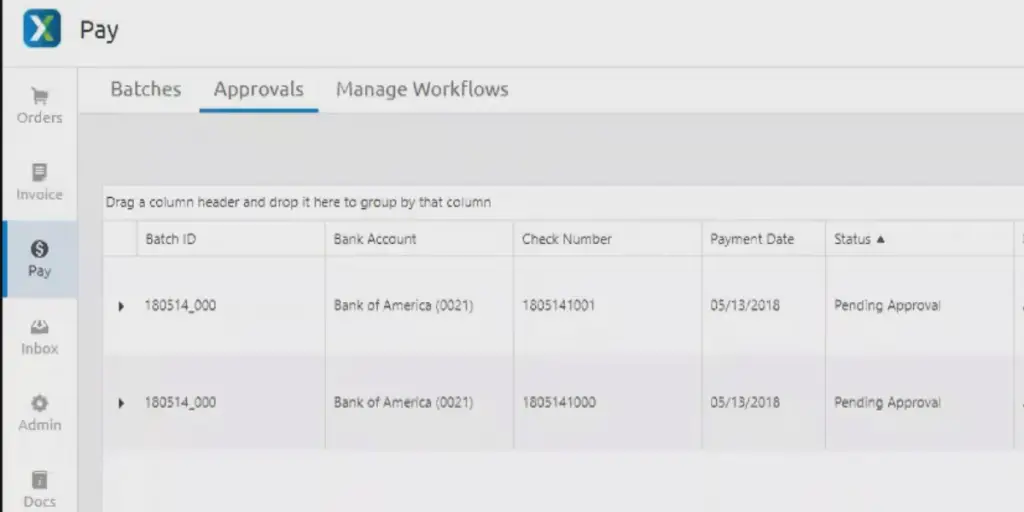

Some screenshots of Avidxchange

Pricing

The vendor does not provide pricing details. Please get in touch with the vendor for the details.

Likes

Likes

- Integrates with many software like QuickBooks, NetSuite, Microsoft Dynamics, etc

- It provides live support

- Holds invoices for seven years

- Provides access to the trainers

- Increases financial security with e-payment

Dislikes

Dislikes

- It does not offer a free trial

- No mobile apps

- Sometimes proof of payment will not be available on the Avidxchange portal

- Payment processing takes time

- There is no option to track the payment

- Due dates are not visible

Supported industries

- Real estate

- Community association management

- Media

- Construction

- Financial Service

- Hospitality

- Technology and software

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported languages | English |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.6 out of 5(92+reviews) G2: 4.4 out of 5 (184+reviews) |

User opinion

Avidxchange is an automation software for invoice automation, purchase orders, and bill payments. It provides live support, retains invoices , offers access to trainers, and boosts financial security through e-payments.

However, there is no free trial or mobile apps, proof of payment sometimes goes missing on the portal, payment processing can be slow, there’s no option to track payments, and due dates are not visible.

It integrates with many accounting software and provides customizable 2-way and 3-way matching capabilities since it is a cloud-based platform and hence provides 24/7 online access.

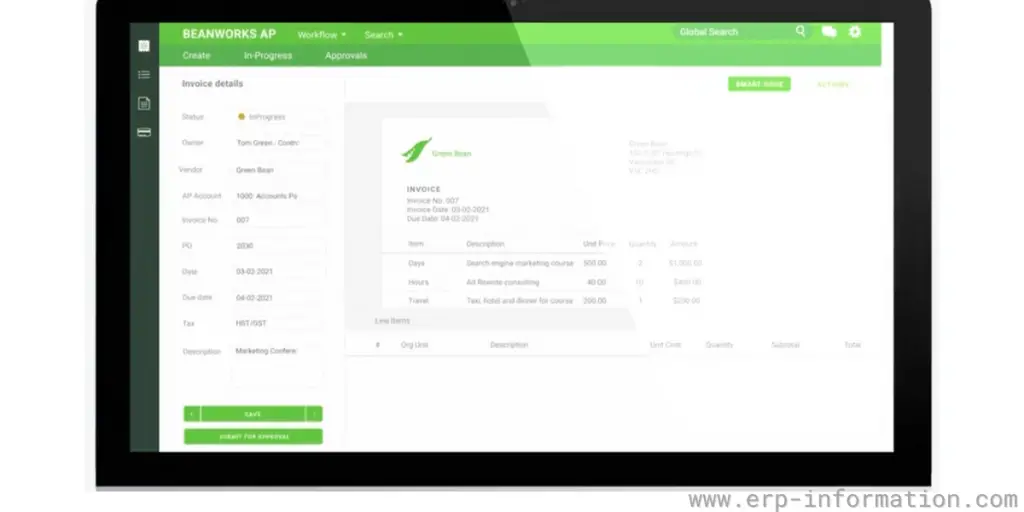

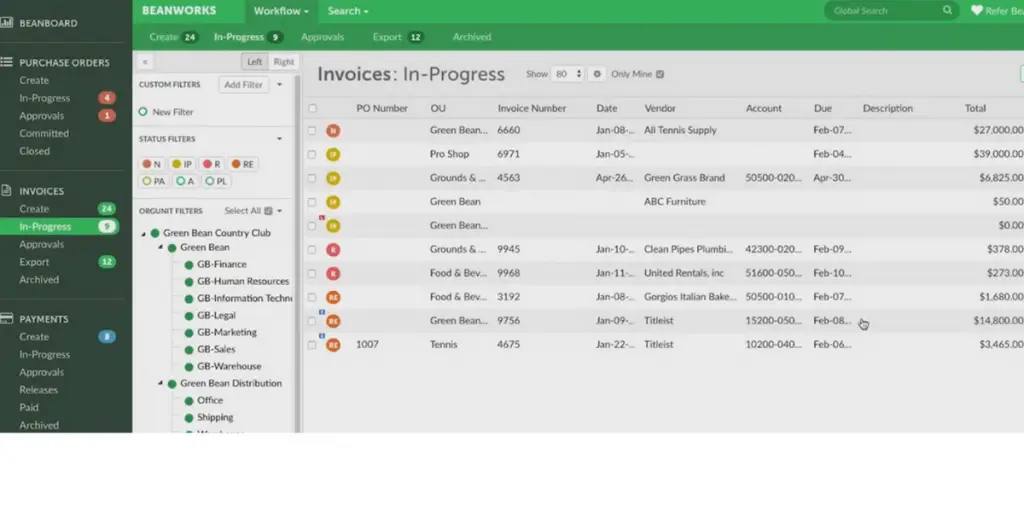

8. Quadient AP by Beanworks

Quadient is a cloud-based account payable automation tool that helps to automate your entire purchase-to-pay workflow. The software is suitable for small, medium, and large enterprises.

Features

- Budgetary control

- Purchase order matching

- Automated approvals

- Invoice approval management

- Electronic audit trail

- Expense management

Some screenshots of Beanworks

Pricing

The vendor does not disclose pricing. Kindly contact the vendor for the details.

Likes

Likes

- Helps to reduce bottlenecks and delays

- Offers centrally managed locations for multiple companies

- Provides access to unlimited users

- Allows you to access and approve invoices on your Android and iOS mobile

- Eliminates duplicate payments

Dislikes

Dislikes

- Tedious invoice processing

- Sometimes, it is difficult to find out the stage of each expense

- Image file containing invoice data can’t be exported

- Search functions are limited

Supported industries

- Financial service

- Healthcare

- Education

- Insurance

- Public sector

- Service providers

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Windows, Linux, Android, iPhone, iPad |

| Supported languages | English, French |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.6 out of 5(37+reviews) G2: 4.6 out of 5 (131+reviews) |

User opinion

It supports unlimited users and enables invoice access and approval on both Android and iOS devices, effectively eliminating duplicate payments.

However, the software could be more user-friendly; invoice processing can be tedious, tracking the stage of each expense can be challenging, image files with invoice data can’t be exported, and the search functions are somewhat limited.

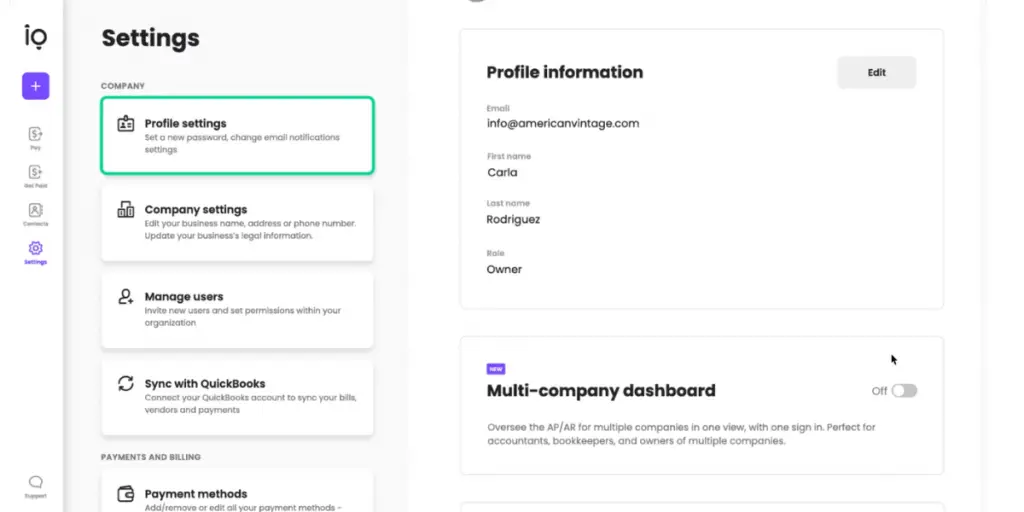

9. Melio

Melio software is a free tool helpful for the invoice payment process. Small and medium-sized businesses can use this software.

It gives flexibility to all your accounting features, such as vendor pay, invoice processing, and vendor selection.

Features

- Accountant Dashboard

- International payments

- Easy bill capture

- Team management

- Workflow approvals

- Pay and get paid

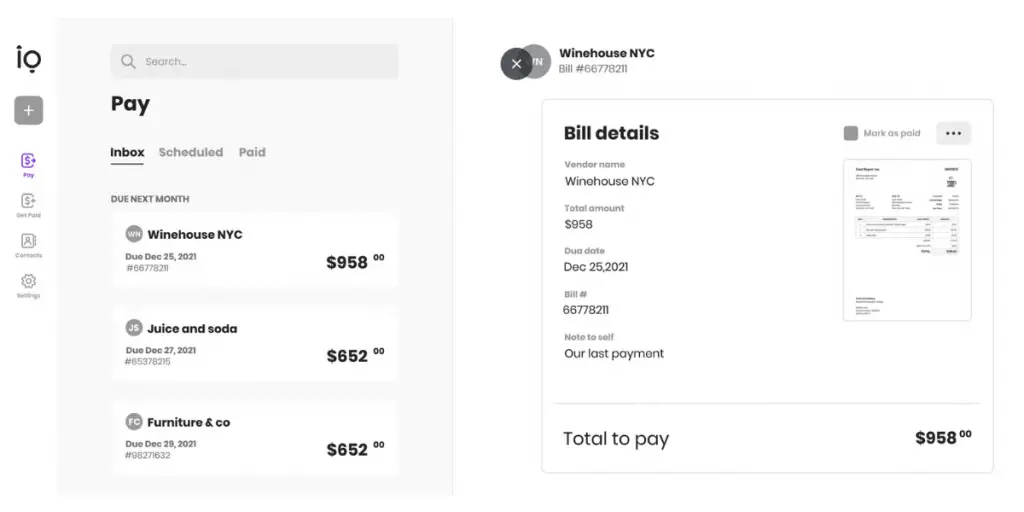

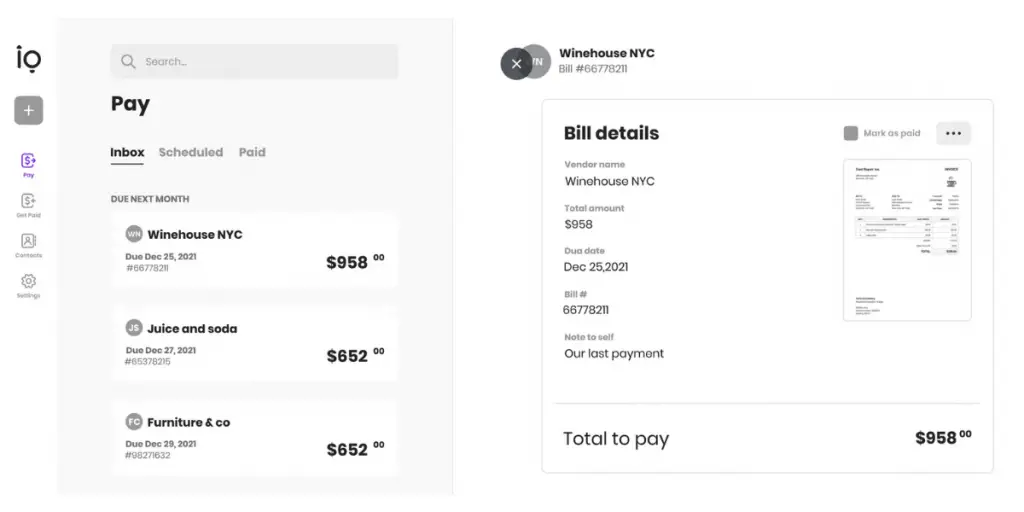

Some screenshots of Melio

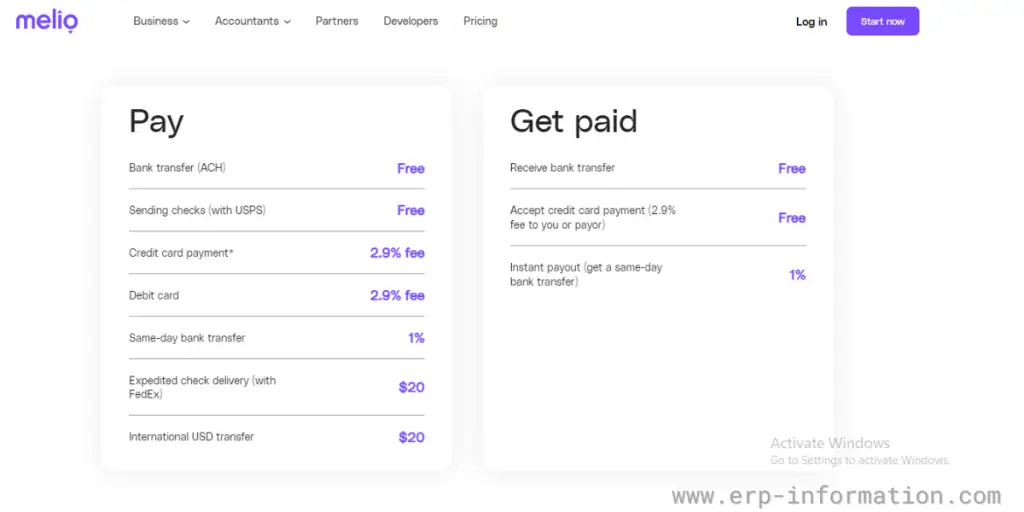

Pricing

It offers two types of pricing options

- Pay – In this option, ACH and check payments are free. However, it offers a 2.9% fee for credit and debit card payments. In addition, it charges $20 for expedited check delivery and an International USD transfer.

- Get paid – It is free but charges 1% for same-day bank transfers.

Likes

Likes

- Free for unlimited users

- Provides live support via chat and email

- Provides control over the workflows

- You can make international payments

Dislikes

Dislikes

- The option to pay multiple invoices with a single click is unavailable

- Customer service is not good

- Lack of integration

- The user interface is somewhat difficult to navigate.

- Lacks the ability to drag and drop multiple invoices or group invoices for the same vendor.

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported languages | English |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Chat |

| Customer ratings | Capterra: 4.2 out of 5 (370+reviews) G2: 4.7 out of 5 (117+reviews) |

User opinion

Melio AP software can be a cost-effective solution with free access for users, live support via chat and email, and robust workflow management. It also supports international payments, enhancing its versatility.

However, it has some limitations, such as the absence of a single-click multiple invoice payment feature, limited integration options, a somewhat challenging user interface, and no drag-and-drop functionality for handling invoices.

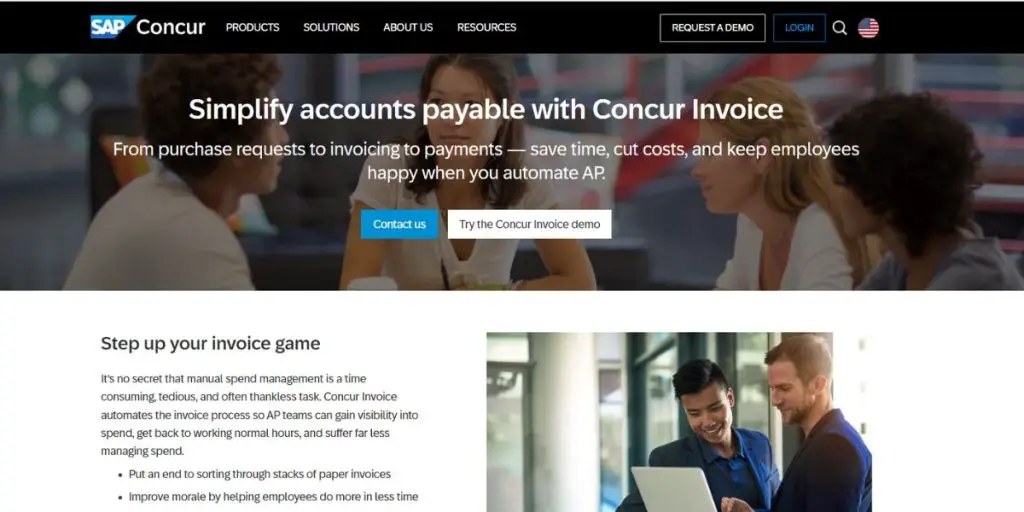

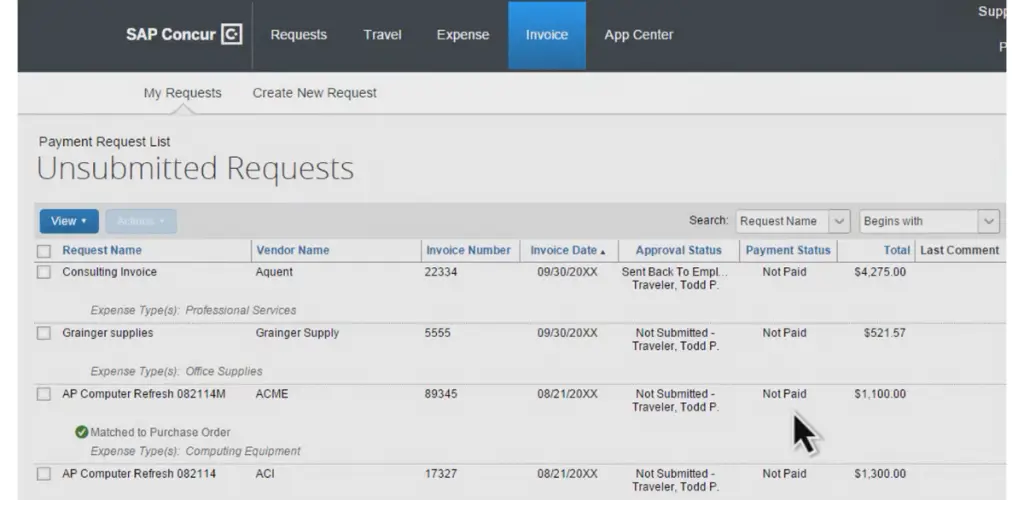

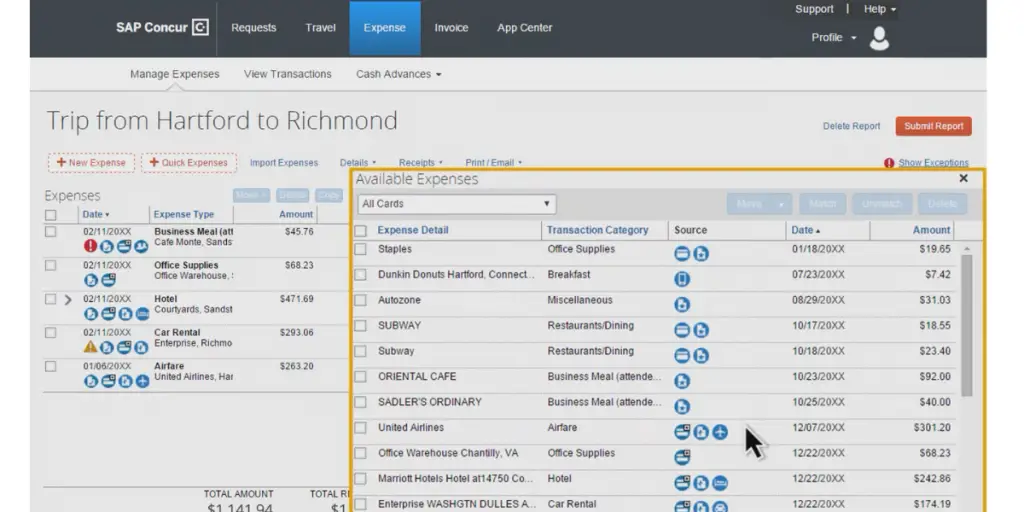

10. SAP Concur

SAP Concur is a software company that provides cloud-based travel and expense management solutions and invoice automation.

SAP Concur automates the accounts payable process, from invoice capture and data entry to approvals and payments. This results in increased efficiency, accuracy, and lower processing costs. It helps time vendor payments accurately, manage cash flow, and integrates with ERP and accounting systems for a comprehensive view of spending.

Features

- Three-way matching

- Integration of concurring invoices with the organization’s ERP system

- Streamline the AP process with web-based and mobile apps

- Pre-defined dashboards and reports

- Integration with payment providers

- Invoice capture

Some screenshots of SAP Concur

Pricing

The vendor does not provide pricing details. However, it offers a free trial.

Likes

Likes

- Enhances compliance and reduces fraud

- Supports mobile apps so that users can access the software anywhere

- Enhances accuracy by eliminating paper works and manual data entry

- Helps to make informed decisions with real-time insights and analytics

Dislikes

Dislikes

- Page error occurs while loading

- You will not get a preview of the invoice

- The learning curve can be tedious

- Needs integrations with other SAP apps for reporting

- UI needs upgrading

- The mobile app is slow

- Some user features are not intuitive, and error messages could be more precise.

- Customer service response time could be improved.

- It is a very expensive tool.

Supported industries

- Consumer products

- Financial services

- Healthcare

- Retail & Restaurants

- Technology companies

- Oil, mine, and gas

- Life science

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported languages | Czech, Danish, German, English, French, Indonesian, Italian, Japanese, Korean, Dutch, Norwegian, Polish, Spanish, Swedish, Chinese (Simplified) |

| Supported device | Mac, Windows, Android, iPhone, iPad |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep), Chat |

| Training | Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.3 out of 5(2033+reviews) G2: 4.0 out of 5 (6033+reviews) |

User opinion

SAP Concur stands out with its strong features aimed at enhancing compliance, reducing fraud, and offering mobile access for on-the-go management. It eliminates paperwork and manual data entry, boosting accuracy and providing real-time insights to support informed decision-making.

However, users have noted some issues, such as page loading errors, the absence of invoice previews, and a steep learning curve. The software also requires integration with other SAP apps for comprehensive reporting.

Its user interface and mobile app could use upgrades, and some features are not very intuitive. The software integrates with popular ERP systems, such as SAP, Oracle, and Microsoft Dynamics, making it easy for businesses that already use these platforms.

FAQs

What are the Advantages of Accounts Payable Automation?

The advantages of automating accounts payable are many and varied but can be summarized as follows:

– Improved efficiency and data accuracy

– Faster processing of invoices

– Reduced Accounts Payable department costs

– Greater visibility and control over Accounts Payable processes

How to Choose the Right Accounts Payable Automation Software

When choosing is vital to consider the following factors:

– Ease of use

– Features

– Integration

– Pricing

Conclusion

Accounts payable automation software is critical for any organization looking to improve its Accounts Payable department.

In this article, we’ve looked at the 10 Accounts Payable & AP Automation Software on the market today so that you can make an informed decision about which solution is right for your organization.

References: