Small businesses need a way to manage their finances, but traditional methods like using a checkbook or Excel are no longer feasible due to the advent of new technologies.

Businesses have had to adapt and change, including managing their finances. Paper-based methods like checkbooks and Excel spreadsheets just don’t cut it anymore- they’re slow, inefficient, and can leave you open to fraud.

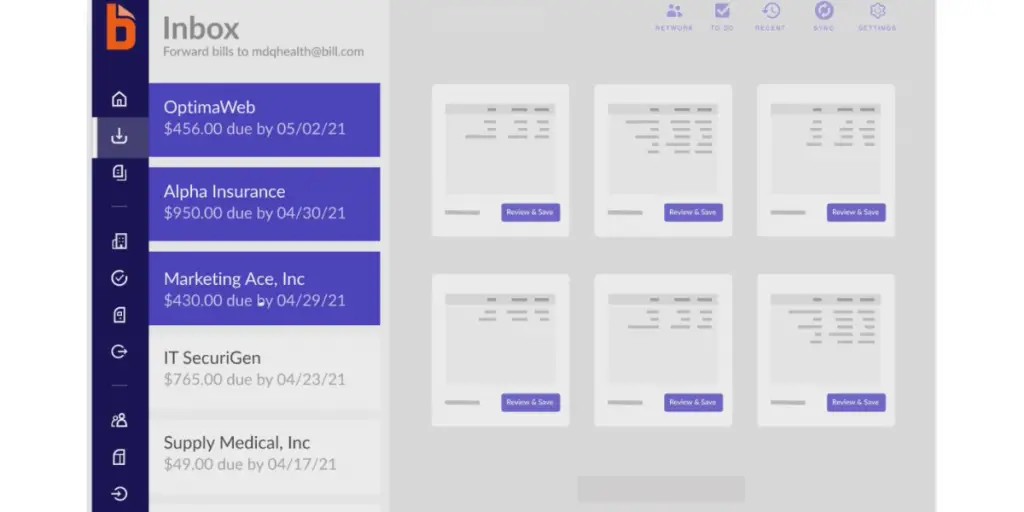

Bill.com is the perfect solution for small businesses looking for an online way to manage their finances. With features like invoicing, payments, and approvals, Bill.com makes it easy to get a quick overview of your company’s financial health.

This article provides in-depth details about Bill.com software, including its features, pricing, pros, and cons.

What is Bill.com?

Bill.com is a cloud-based software that helps businesses automate their financial operations, like accounts payable and receivable.

It makes it easier and faster for companies to pay their bills, get paid by customers, and track their finances. Millions of businesses around the world use Bill.com.

More details about Bill.com

The software is trusted by over 4.7million network members, including TED, Quicken, Thumbtack, Fortis, and Wag.

BILL.com helps businesses connect to a network of millions of people. This allows them to get paid and pay others faster. BILL’s tools help small businesses manage their money better so they can do well in business. BILL works with big banks, accounting companies, and software providers in the U.S. It is based in San Jose, California. To learn more, go to Bill.com

Products

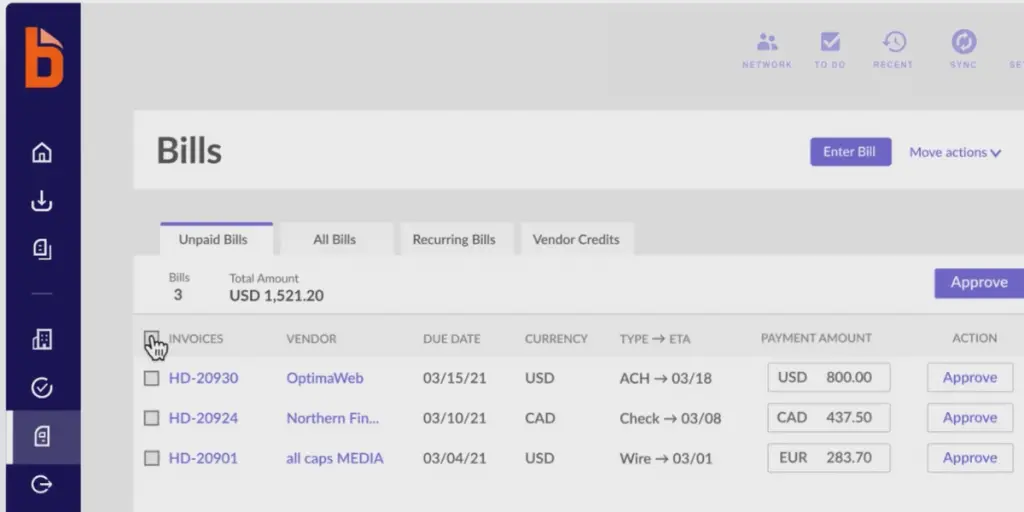

Accounts Payable

- You can easily enter the bills.

- Automats approval process

Accounts Receivable

- It enables you to create professional invoices by allowing you to customize fields.

- Provides various ways to send invoices like email

- You can track your invoice status easily

- You can get faster payments

Credit and Expense Management

- Provides business credit, expense management, and spending management.

Features

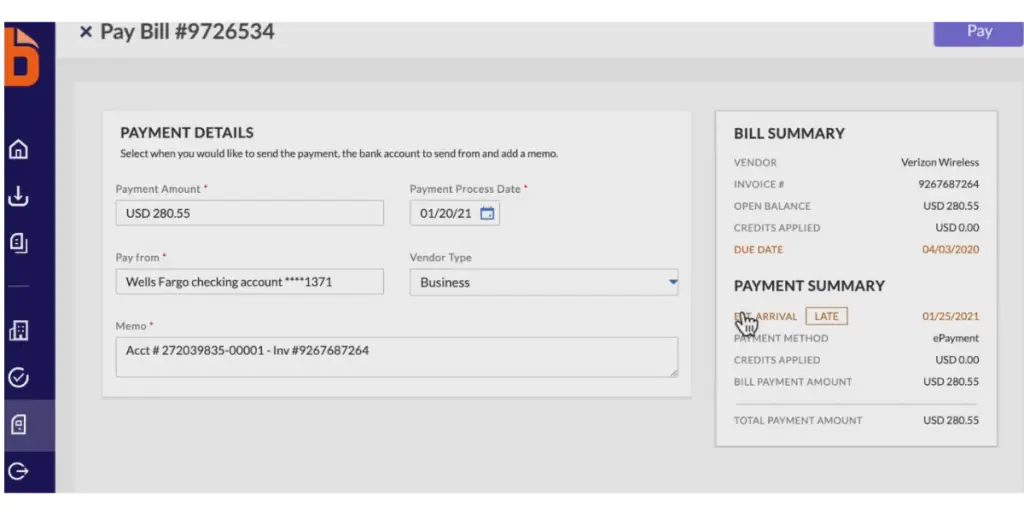

Payments

The software allows you to make payments with various methods. They are

ACH

It offers less processing time. It takes almost two to five days to deliver. It provides more flexibility and control over cash flows. It offers digital payments and hence reduces the risk of paper check theft. It is a cost-effective solution.

Virtual cards

It offers one-time use of the account number and is used to facilitate payment of a single supplier invoice.

Pay by card

If you use credit cards, it offers rewards and reduces manual errors.

International wire

You can make international and domestic payments in over 130 countries with the help of an international wire.

Print and mail services

It enables you to pay your vendors with paper checks.

Faster checks

It allows you to process payments fast.

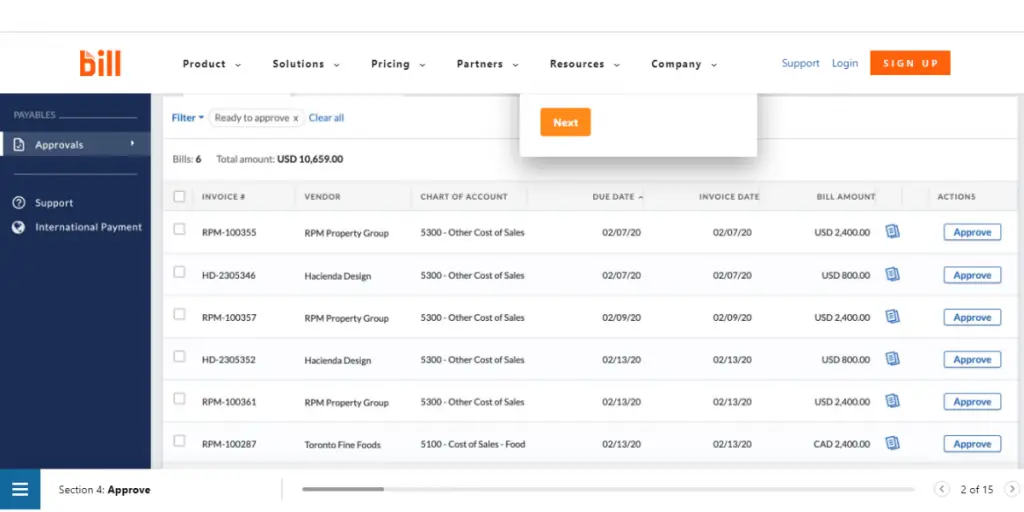

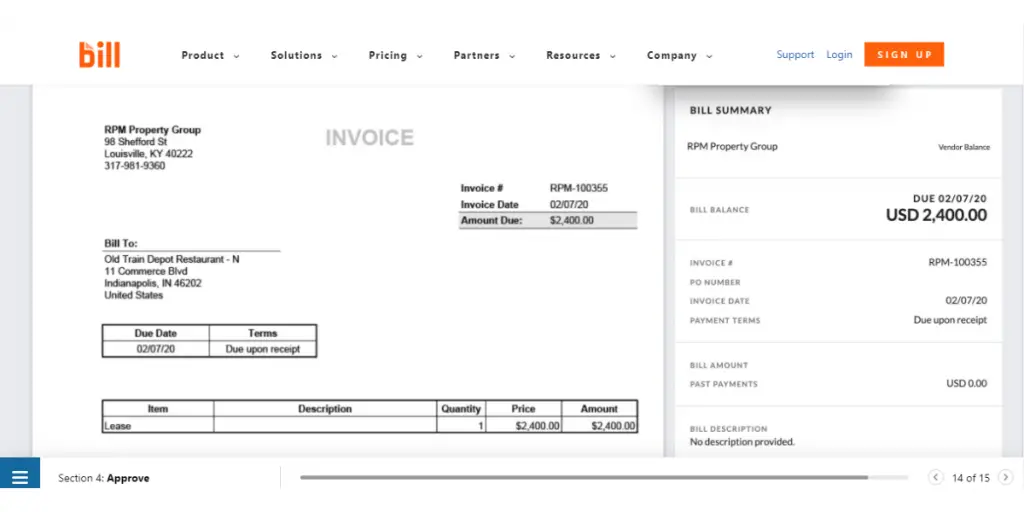

Approvals

- This feature allows you to have control over your entire accounts payable process.

- You can track and monitor approvals in each step.

- The feature helps to control fraud.

- No need to take physical signatures. You can request and accept approvals digitally.

- It allows you to send invoices to the right person at the right time.

- It enables you to do approvals using mobile apps.

Controls

- Provides transparency into your AP workflow

- Provides a 360-degree view of payments

- Provides comprehensive vendor details

- Easy tracking of approvals and payment status

Invoicing

- It enables you to create invoices automatically.

- Enables customers to make payments easily through credit cards and ACH

- It provides professionally designed templates

- You can customize the invoice with your logo and organize the fields.

API

- This feature allows you to process high volumes of payments, and all information is coded using Transport Layer Security (TLS).

- Allows you to build syncs and integrations to automate accounts payable and receivables.

- It provides robust documentation.

Integrations

- It integrates with Quickbooks, Xero, Oracle NetSuite, Sage Intacct, and MS Dynamics.

Security

- Its multi-layered security technology avoids payment fraud, network security breaches, and unauthorized account access. It also protects customer data.

- It adheres to AICPA (American Institute of CPAs)SOC 2 compliance

- The software does not use third-party services to issue payments, giving you more control over your payments.

Mobile Apps

- The software provides mobile apps for reviewing and approving bills.

- You can get real-time messages/alerts.

Artificial intelligence

- With the help of AI, you can upload and extract the invoice within a second.

- You can separate multiple documents and detect duplicates.

Pricing of Bill.com

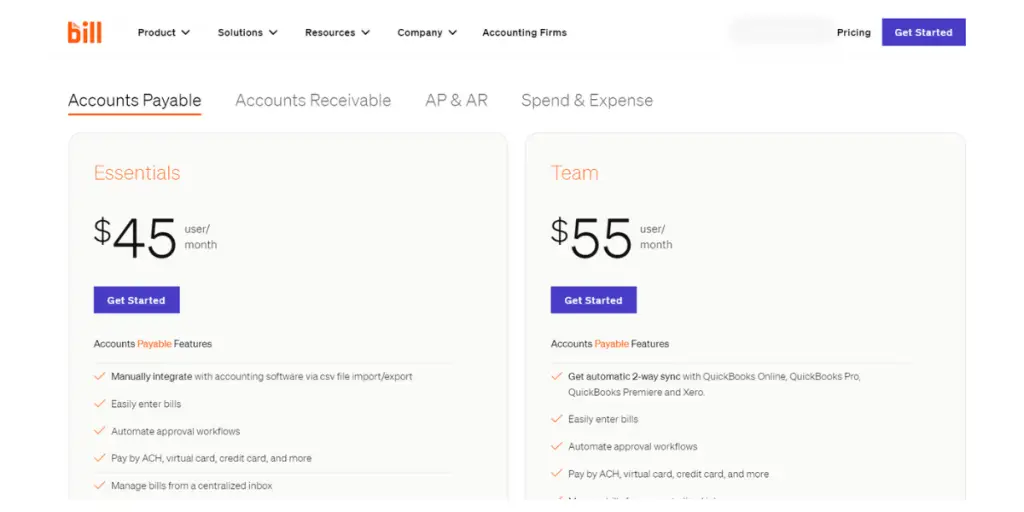

The software offers different pricing plans for Businesses and Accounting firms.

Pricing plans for the Accounting firm

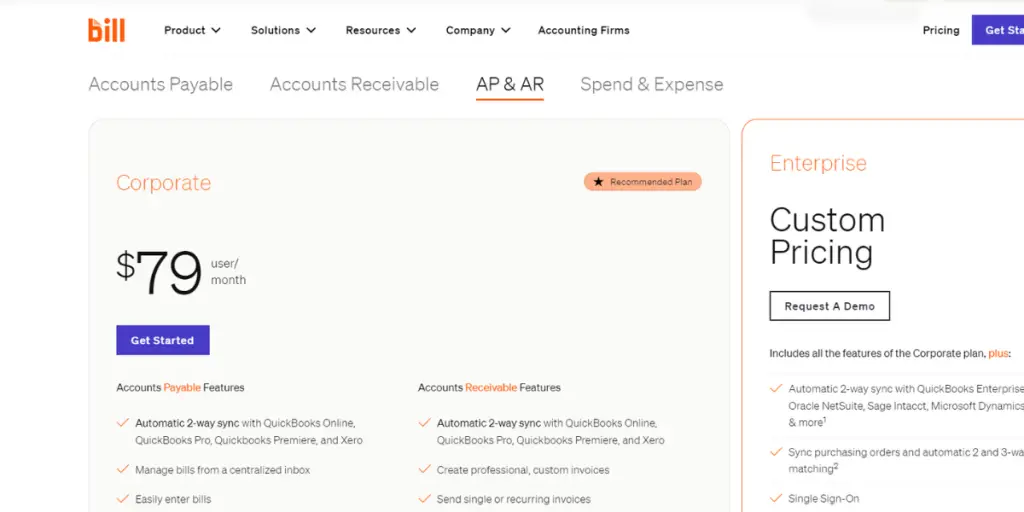

Pricing plans for Businesses

It offers three different plans for businesses.

| AP & AR | Account payable |

| Corporate plan – It starts at $79 per user per month | Essentials – It starts from $45 per user per month. |

| Enterprise plan – You need to contact the vendor for pricing details. | Team – It starts at $55 per user per month |

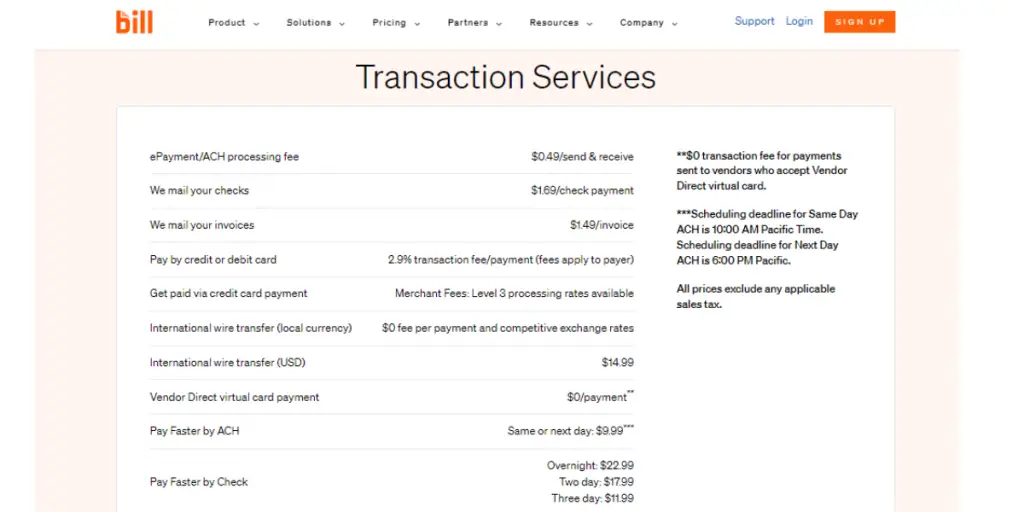

Other pricing details

Apart from pricing plans, have a look at the transaction service prices.

They are as follows.

| ePayment/ACH processing fee | $0.49/send & receive |

| We mail your checks | $1.69/check payment |

| We mail your invoices | $1.49/invoice |

| Pay by credit or debit card | 2.9% transaction fee/payment (fees apply to payer) |

| Get paid via a credit card payment | Merchant Fees: Level 3 processing rates are available |

| International wire transfer (local currency) | $0 fee per payment and competitive exchange rates |

| International wire transfer (USD) | $14.99 |

| Vendor direct virtual card payment | $0 per payment |

| Pay faster by ACH | Same or next day: $9.99 |

| Pay faster by check | Overnight: $22.99 Two days: $17.99 Three days: $11.99 |

Supported industries

- Accounting Firms

- Healthcare

- Hospitality

- Manufacturing

- Nonprofits

- Professional Services

- Retail and E-commerce

- Software and Technology

- Wealth Management

Pros

Pros

- The software provides almost all features to automate your financial operations.

- It integrates with Quickbooks, Xero, Oracle Netsuite, Sage Intacct, and MS Dynamics.

- You can change the permissions for each user.

- It provides expense and spend management.

Cons

Cons

- Customer service is very poor.

- It will not allow you to save templates sent to vendors, customers, or subscriptions.

- Sometimes, it sends phishing emails to vendors. And customer service does not give any advice to stop it.

- There is no way to turn off automatic payment reminders.

- Bill.com sends emails with its product offerings to your vendors without your consent.

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Headquarters | San Jose, California, United States |

| Supported device | Android, iPhone, iPad |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, Chat |

| Training | In-person, Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.2 (422+reviews), G2: 4.5 (1007+reviews) |

Conclusion

If you are looking for a comprehensive software solution to automate all your financial operations, bill.com is the answer. It offers a wide range of features at an affordable price and has a user-friendly interface.

However, it lacks customer support. This blog post has covered its products, features, pricing details, and pros and cons.

Reference