External asset management allows a third party to handle the management and maintenance responsibilities associated with an organization’s non-core assets.

This can include anything optional to the business’s operations, such as real estate, equipment, or other investments.

In the past ten years, a financial revolution has unfolded in Asia. Private wealth management is no longer exclusively guided by large banks and corporations, as independent asset managers have spread across Hong Kong and Singapore- now counting 160 firms collectively managing US$91.5 billion of assets!

As a result, what was an unknown sector just a decade ago has quickly become integral to Asian finance today.

This can help to improve an organization’s cash flow, eliminate unnecessary risks, and bring in additional revenue streams through optimized asset utilization.

This blog post will provide you with the complete details of External asset management, how it works, who is an external asset manager, and what his responsibilities are.

What is external asset management, and how does it work?

External asset management handles your financial assets and investments without taking charge of them. Instead, a custodian, usually a bank with the relevant license, will be needed to oversee this process – so you can breathe easy as they won’t possess withdrawal powers over funds.

To do this successfully, a custodian – such as a bank with the necessary authorizations – will act on their behalf under strict limitations regarding investments made and funds withdrawn.

The EAM allows organizations to focus on their core competencies instead of managing these assets themselves, freeing up resources that can be used for strategic endeavors.

The third-party manager monitors and optimizes the asset’s performance and value over time, ensuring it meets all legal requirements and regulations.

External asset management works by having a third-party manager take on the responsibilities associated with an organization’s non-core assets.

- This includes monitoring and optimizing the asset’s performance and meeting all legal requirements and regulations.

- The third-party will also manage any associated risks while ensuring its value is maintained over time.

- Additionally, they can help identify new ways in which assets can be utilized to generate additional revenue streams and optimize the organization’s cash flow.

- Finally, external asset managers can often provide valuable advice on managing these assets better to maximize returns.

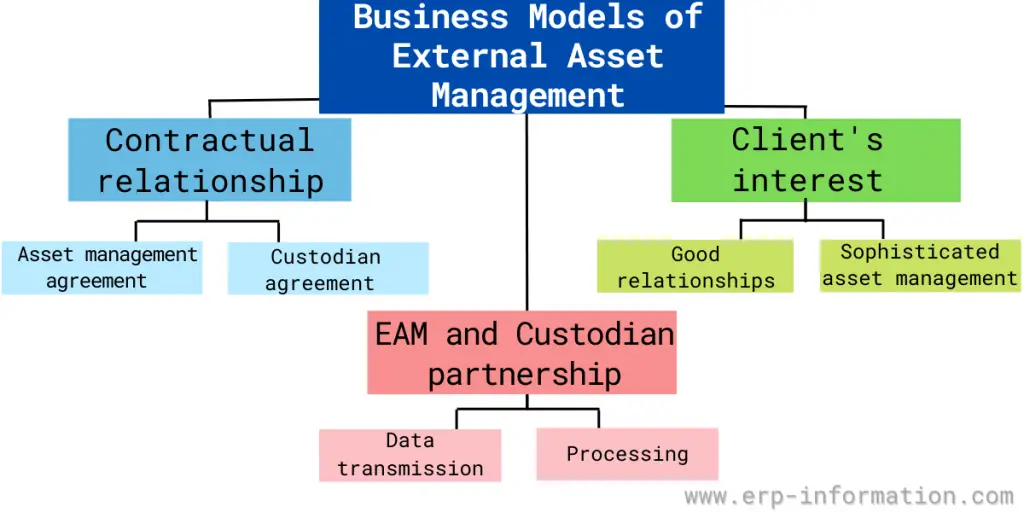

Business models of external asset management

Contractual relationship

The contractual relationship includes agreements. The first agreement is with the asset management company. This company will manage your assets and make investment decisions. The second agreement is with the custodian.

The custodian will keep your assets safe. The final deal is between the asset management company and the custodian. This agreement lets the custodian provide extra services to you.

Client’s interest

The EAM is designed to provide tailored and flexible solutions that align with clients’ interests. This way, clients receive individualized services and can expect continuity without depending too much on any one service provider. In addition, EAMs focus on maintaining good relationships with their clients and providing sophisticated asset management services.

EAM and Custodian partnership

The partnership between EAM and the custodian is important for quality and client satisfaction. The onboarding process is one example of collaboration between EAM and custodian that impacts the client journey. Data transmission and processing between them is another critical parameter for service delivery.

Who is the external asset manager?

External Asset Managers (EAMs) are private companies that provide custom asset management services to wealthy clients.

EAMs are also called Independent Asset Managers (IAMs). They are also called Relationship managers.

Instead of taking on long-term control over financial assets, an External Asset Manager is an independent professional able to provide sound investment advice and administer your wealth without assuming custody.

What are the responsibilities of an external asset manager?

Portfolio management

The primary responsibility of an external asset manager is to execute the portfolio management strategy on behalf of the investor or client. This includes setting up and maintaining a diversified mix of investments that match each investor’s desired risk/return profile.

The role typically involves managing the day-to-day operations related to portfolio management, such as tracking investment performance against benchmark indices and reporting this information back to investors, monitoring cash transactions, preparing reports detailing any changes in strategies, and many more.

Structured asset management

External asset managers will typically use a structured approach for investing. For example, this can involve creating an investment policy statement that outlines the investor’s goals, time horizon, level of risk tolerance, execution guidelines (e.g., distribution of assets across different classes), rebalancing strategies, etc.

With an appropriate plan in place, the external asset manager can select specific investments within each class that meet these criteria utilizing various research sources such as independent rating agencies or proprietary data providers like Morningstar or Lipper International.

Corporate financing and advisory services

External asset managers will be responsible for providing strategic advice to their clients to create a plan for optimal capital allocation. This includes researching potential investments, analyzing market trends, and developing financial risk analysis models to guide the best way to allocate assets for maximum returns.

An external asset manager must ensure that all corporate financing activities are conducted within applicable laws, regulations, and industry standards.

Agency planning and wealth structuring

External Asset Managers are multi-faceted. As professional asset managers, their primary responsibility is to help clients create a long-term investment strategy to ensure their financial security through retirement.

Legacy planning and wealth structuring include providing input on the estate or trust matters such as tax strategies or charitable giving options when applicable; responding promptly when contacted about markets’ movements; negotiating fees associated with private placements; interacting positively with third-party vendors like accountants or attorneys; conducting periodic reviews/meetings with clients etc.

All these activities are designed to ensure seamless succession planning, which allows maximum benefits realization upon death in terms of costs incurred due to estate regulations but, more importantly, provides comfort and peace of mind during a lifetime for the investors who can rely on timely advice given by highly qualified professionals employed by external asset managers.

Alternative Investment

External asset managers must use deep knowledge and expertise of the markets to identify suitable investments to deliver superior returns for their clients. This requires conducting extensive due diligence on potential investments and creating diversified portfolios tailored to investors’ individual needs.

In particular, external asset managers should be able to assess the risk vs. reward profile of each investment opportunity they come across while taking into account factors such as:

- Size of the deal relative to the total portfolio

- Management team

- Competitive environment

- Downside protection strategies

- Exit options available etc

They should understand regulatory frameworks applicable in different countries/markets across which they may invest funds on behalf of their clients, including the Foreign Corrupt Practices Act (FCPA) Anti Money Laundering (AML) regulations, among others.

Reason to choose EAM

- External asset management may be a good option for independent investment advice and asset management services for the client.

- The client might prefer working with a smaller organization with which they have a good relationship rather than an overwhelmingly large institution.

- They may also be disillusioned with their current provider for various reasons.

- An attractive point for the client is that they do not have to move their assets from their current bank.

- As long as the EAM has a custodian agreement with their bank, their assets stay safe, and all asset management is handled by the EAM exclusively.

Challenges

- Challenges faced by external asset managers include finding a suitable partner who is experienced and knowledgeable in the field,

- Incurring extra costs due to a lack of efficiency and a clear understanding or vision of an organization’s long-term objectives or goals.

- Managing assets that are outside their area of expertise.

- Trust and communication between the two parties can be challenging since the third party ensures that the organization’s assets remain secure.

- Disagreements could arise when setting up business processes that could result in delays or conflicts.

- External Asset Managers tend to be leaner than banks and have lower overhead costs. As a result, they can be more competitive in pricing.

Best EAM solutions

- ABB Lumada EAM

- ACCELA

- IBM Maximo

- Upkeep

- Fracttal one

- FIIX

- HxGN EAM

- MVP One

- Accruent maintenance connection

- eMaint CMMS

- Redlist

FAQs

What is an External Asset?

For any person on any given date, external assets are that person’s total assets after getting rid of intercompany assets and investments in subsidiaries.

Conclusion

Overall, external asset management can be a complex and challenging task. It requires the right partner who is experienced in the field and understands the organization’s long-term objectives or goals.

Additionally, strategies such as building trust and communication between parties, setting clear, achievable goals, and maintaining a comprehensive inventory of assets help to ensure success.

Moreover, it is important to keep up with industry regulations and review contracts regularly to ensure that all assets are managed securely and efficiently.