The DCAA (Defence Contract Audit Agency) is a government organization that audits government contractors to ensure they follow the rules and regulations for accounting and costing.

Government contractors often find themselves in need of an accounting system that the DCAA approves. However, this approval can be challenging, as the DCAA has specific requirements for what constitutes an approved system.

In this blog post, we will look at the requirements for a DCAA approved accounting system and how you can get your system approved. The post will also provide a list of DCAA approved accounting systems.

What is DCAA Approved Accounting System?

DCAA approved accounting system is an accounting system that meets the standards set by the Defense Contract Audit Agency. To be approved by the DCAA, an accounting system must meet specific requirements.

These requirements are outlined in the Federal Acquisition Regulation (FAR) and Cost Accounting Standards (CAS). So what is the purpose of a DCAA Approved Accounting System?

A DCAA approved accounting system aims to ensure that government contractors follow the rules and regulations for accounting and costing.

The DCAA has specific requirements for what constitutes an approved system, and contractors often need an accounting system that the DCAA authorizes.

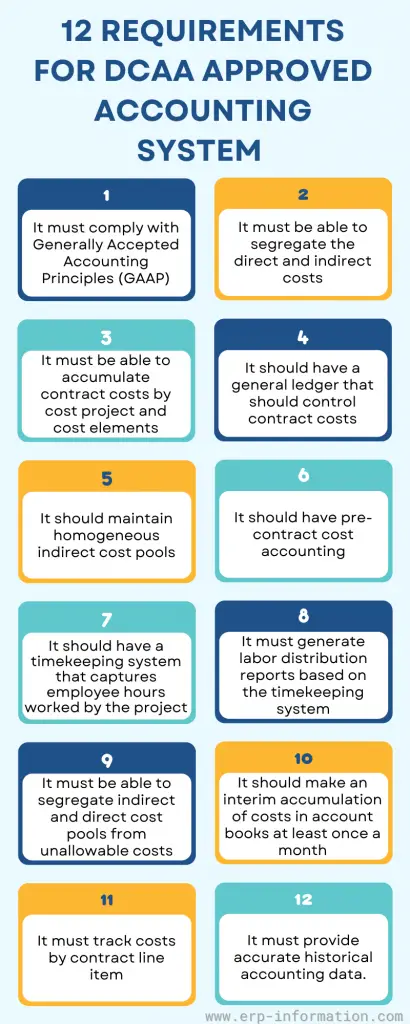

What are the requirements for a DCAA approved accounting system?

There are twelve requirements (we can call it twelve key elements also) for a DCAA approved accounting system.

- The system must comply with Generally Accepted Accounting Principles (GAAP).

- It must be able to segregate the direct and indirect costs.

- It must accumulate contract costs by cost project and cost elements.

- It must have a general ledger that should control contract costs.

- It must maintain homogeneous indirect cost pools.

- It must have pre-contract cost accounting.

- It must have a timekeeping system that captures employee hours worked by the project.

- It must generate labor distribution reports based on the timekeeping system.

- It must be able to segregate indirect and direct cost pools from unallowable costs.

- It must make an interim accumulation of costs in account books at least once a month.

- It must track costs by contract line item.

- It must provide accurate historical accounting data.

Types of DCAA Audits

The DCAA performs various types of audits.

The three main types of DCAA audits are pre-award, post-award, and compliance.

Pre-Award Audit

The pre-award audit is an audit that is conducted before a contract is awarded. The pre-award audit ensures that the contractor complies with the FAR and CAS.

Post-Award Audit

The post-award audit is an audit that is conducted after a contract is awarded. The post-award audit aims to ensure that the contractor is performing under the contract terms.

Compliance Audit

The compliance audit is an audit that is conducted to ensure that the contractor complies with the FAR and CAS. The compliance audit may be performed at any time during the contract’s life.

How to get the accounting system approved by the DCAA?

To get a DCAA-approved accounting system, you can follow these steps:

Understand the DCAA requirements

The DCAA has a number of requirements for accounting systems, which are outlined in the Defense Contract Audit Agency (DCAA) Accounting System Requirements (ASR). The ASR is available on the DCAA website.

Choose the right accounting software

Several accounting software packages are designed to meet the DCAA requirements. While choosing an accounting software package, it is important to ensure it can generate the reports that the DCAA requires.

Implement the accounting software and configure it to meet the DCAA requirements

Once you have chosen an accounting software package, you must implement and configure it to meet the DCAA requirements. This may require you to make changes to your accounting procedures and controls.

Document your accounting system and procedures

The DCAA requires that you have documentation of your accounting system and procedures. This documentation should include a description of your accounting system, your accounting procedures, and your internal controls.

Make sure the accounting system gets audited by a DCAA-approved auditor

Once you have documented your accounting system and procedures, you need to have your accounting system audited by a DCAA-approved auditor.

The auditor will assess your accounting system to determine whether it meets the DCAA requirements.

Submit your accounting system to the DCAA for approval

Once your accounting system has been audited and approved by a DCAA-approved auditor, you can submit it to the DCAA for approval. The DCAA will review your accounting system and determine whether it meets its requirements.

More Tips : To get your accounting system approved by the DCAA, you must submit a request for a proposal (RFP) to the DCAA. The RFP must include a description of your accounting system and how it meets the requirements for a DCAA-approved system.

The DCAA will review your RFP and determine whether or not your accounting system is compliant with the FAR and CAS.

If your system is found to be obedient, the DCAA will issue you a Certificate of Compliance. This Certificate of Compliance will allow you to bid on and perform government contracts.

List of DCAA approved accounting system software

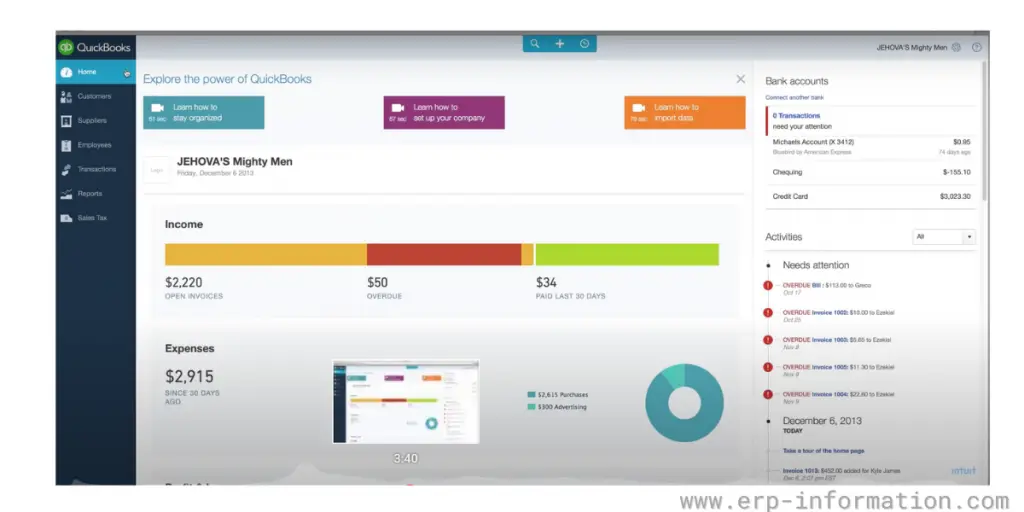

1. QuickBooks

QuickBooks is a popular, easy-to-use accounting system that can be used for businesses of all sizes. It is approved by the DCAA and meets all requirements for an approved accounting system. It is suitable for companies like new businesses, small and mid-size businesses, and freelancers.

Features

- Manage bills

- Track income and expenses

- Invoice customers

- Reports

- Maximize tax deductions

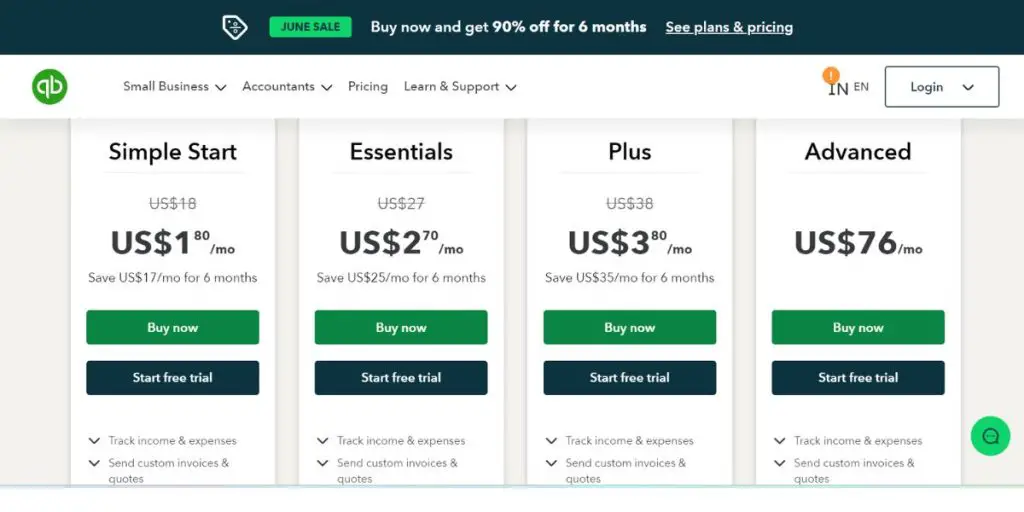

Screenshots of QuickBooks

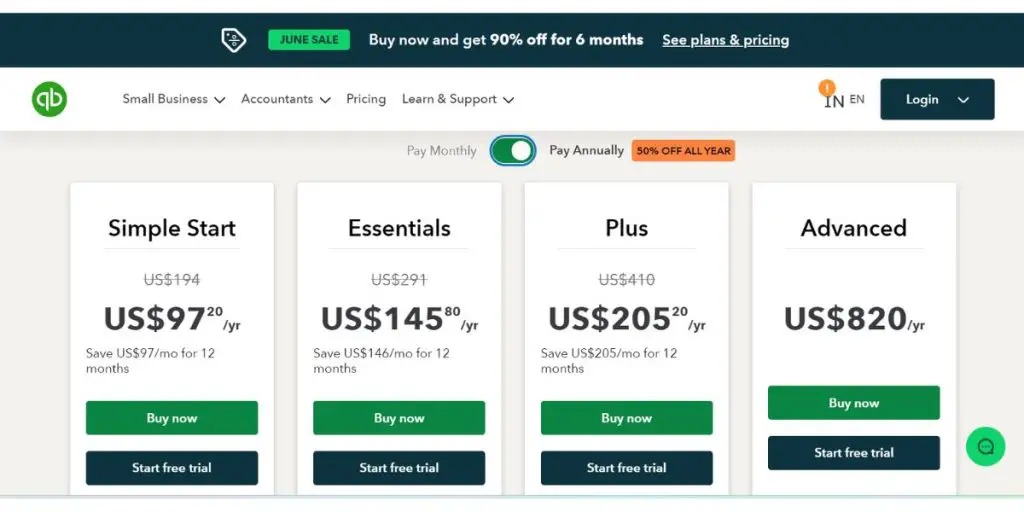

Pricing

It offers four types of pricing plans.

- Simple start – US$18 per month, US$194 per year

- Essentials – US$27 per month, US$291 per year

- Plus – US$38 per month, US$410 per year

- Advanced – US$76 per month, US$820 per year

Currently (June 2024), it is offering 90% off for 6 months except Advanced Plan. Hence the prices are as follows.

- Simple start – US$1.8 per month, US$97.20 per year

- Essentials – US$2.7 per month, US$145.80 per year

- Plus – US$3.8 per month, US$205.20 per year

- Advanced – US$76 per month, US$820 per year

Likes

Likes

- Simplifies all accounting tasks.

- Widely used by businesses of all sizes.

- Provides accurate data reporting.

- Integrates well with other platforms and software.

- Easy setup for sending customer invoices and managing payments and receipts.

- User-friendly interface for quick learning and usage.

- Offers multiple payment options like ACH, credit card, and PayPal.

- Supports multiple users across different locations.

Dislikes

Dislikes

- Customer service needs improvement.

- Limited customization options for specific needs.

- Difficult account recovery if you forget your password or phone number.

- Lacks functionality to send sales receipts for bank transactions.

- Match feature for bank transactions does not work well.

- Contains more bugs than expected.

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Mac, Windows, Android, iPhone, iPad |

| Supported languages | English |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, 24/7 (Live Rep), Chat |

| Training | Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.3 out of 5 (5931+ reviews), G2: 4.0 out of 5 (3255+reviews) |

User opinion

QuickBooks accounting software simplifies all accounting tasks and is widely used by businesses of all sizes. It provides accurate data reporting and integrates well with other platforms and software. It offers multiple payment options like ACH, credit card, and PayPal, and supports multiple users across different locations.

However, customer service needs improvement, and some users find it difficult to fully customize certain features. Account recovery can be challenging if you forget your password or phone number, and the software lacks the functionality to send sales receipts for bank transactions.

2. Accounting Seed

Accounting Seed is a DCAA approved accounting system that offers a variety of features to help businesses manage their finances. It is easy to use and suitable for companies of all sizes.

Features

- Financial dashboards and reports

- General ledger

- Project accounting

- Tax accounting

- Order management

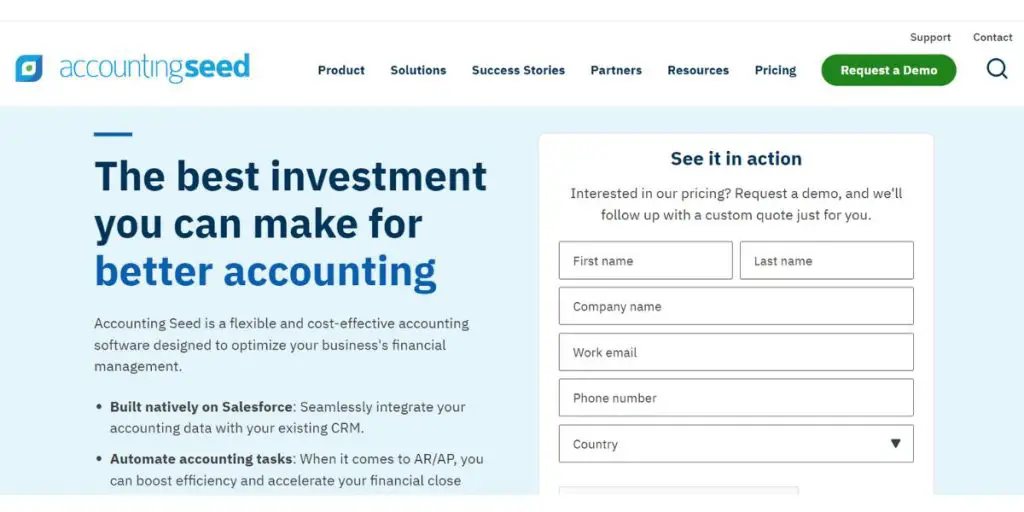

Pricing

To get pricing of Accounting Seed financial software, you need to fill out the form available on its official website.

Supported industries

- Automotive

- Construction and Maintenance

- Education

- Energy and Utilities

- Financial services

Likes

Likes

- It provides customizable options to meet specific needs

- Invoice creation is easy and secure, even you can send them to clients from anywhere

- The platform is straightforward to use and effective

- It is easy to integrate and automate data sourcing

- Easily connects to banks and other financial institutions

- This software is scalable and flexible

- The system is easy to use and displays transactions clearly and concisely, making them easy to understand

Dislikes

Dislikes

- The mobile application is unavailable for iOS version 17

- Implementation and maintenance are costly, particularly for small businesses

- Increased flexibility in payment settings would be beneficial for users

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported languages | English |

| Support | Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support |

| Training | Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.3 out of 5 (91+ reviews) |

User opinion

AccountingSeed software is highly customizable, user-friendly, and effective, with strong integration capabilities and clear transaction displays.

However, the absence of a mobile application for iOS version 17 and the cost of implementation and maintenance, particularly for smaller businesses are major downsides. Additionally, more flexibility in payment settings would enhance the user experience.

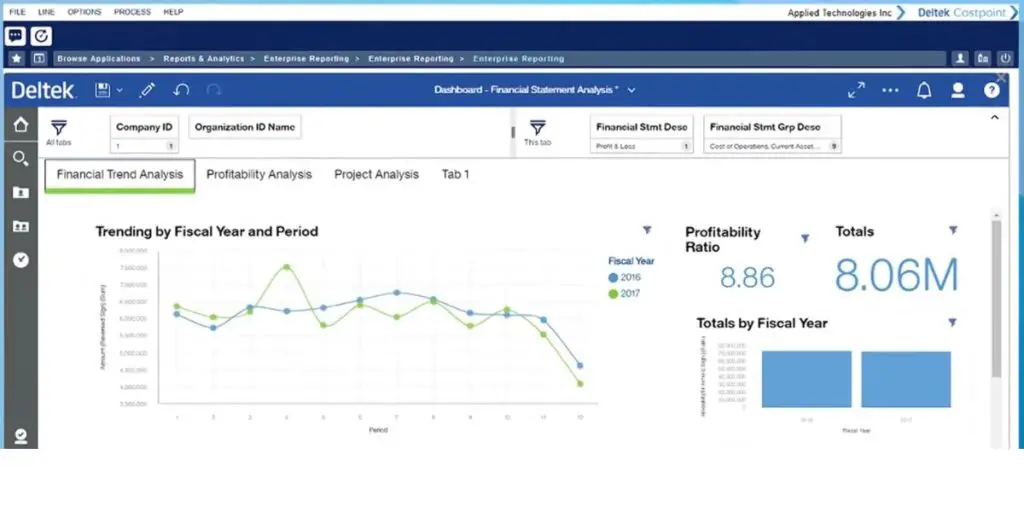

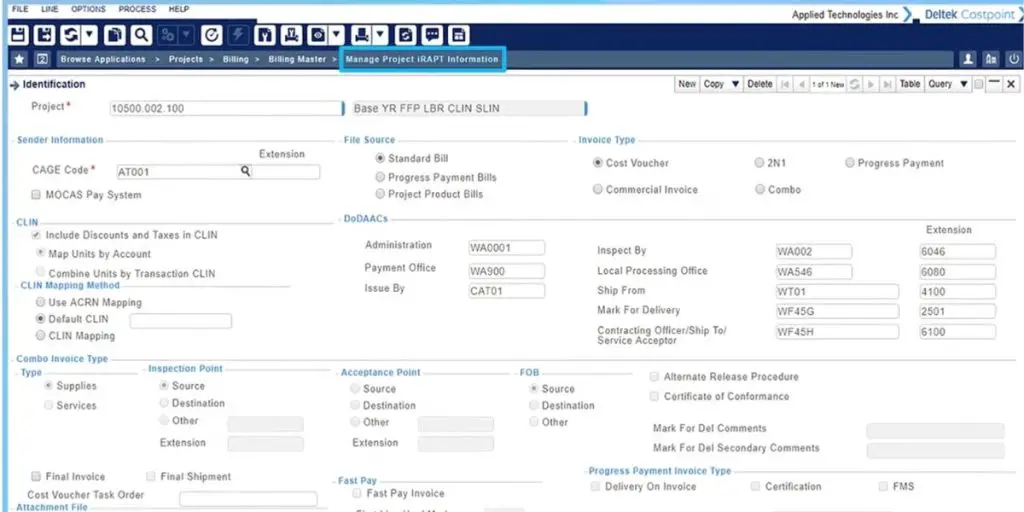

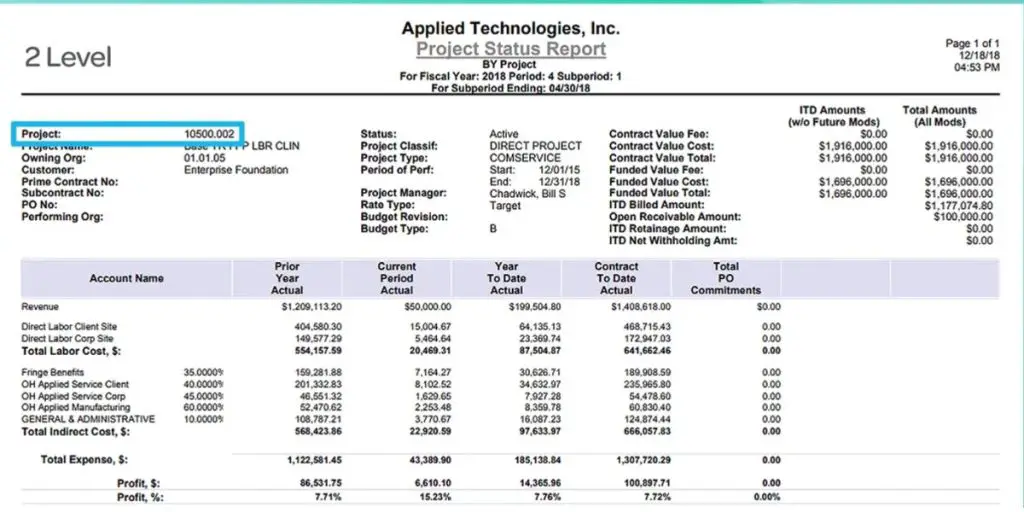

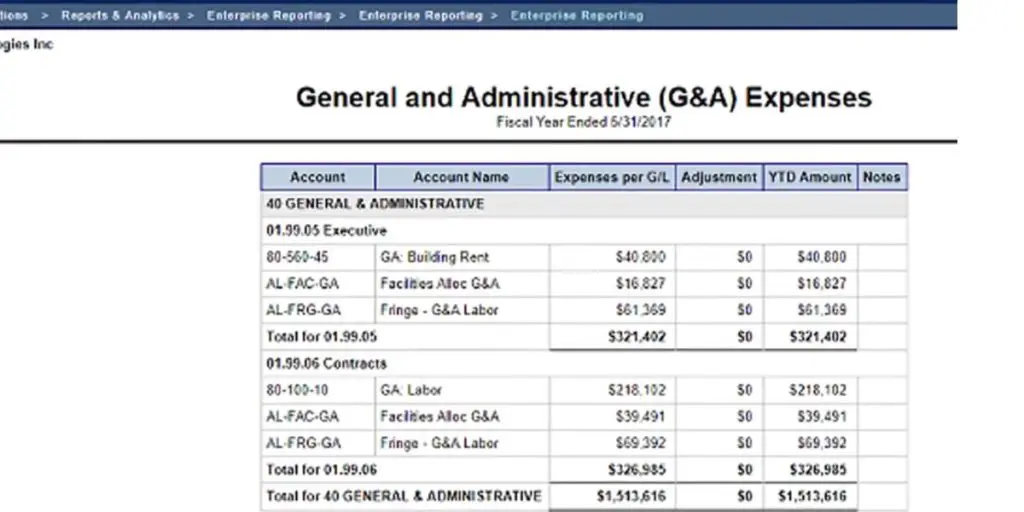

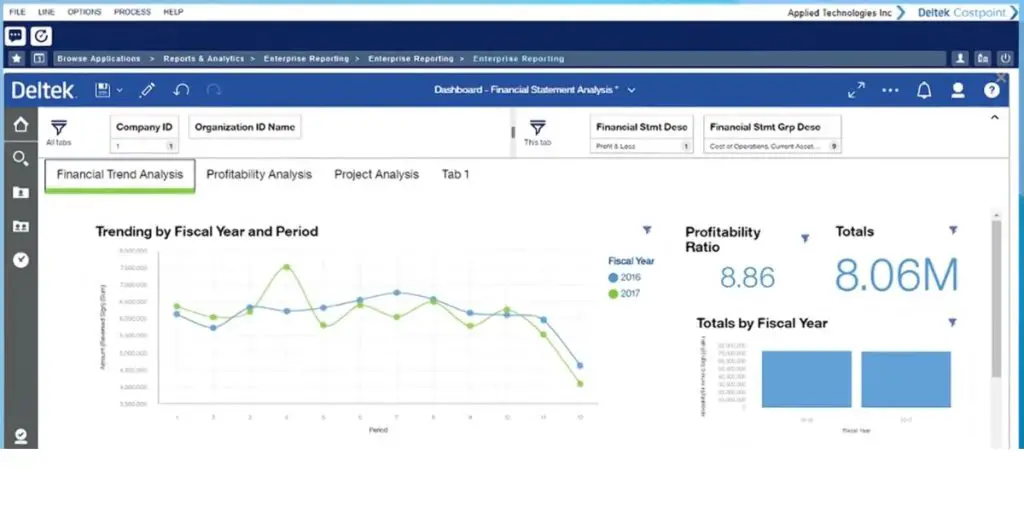

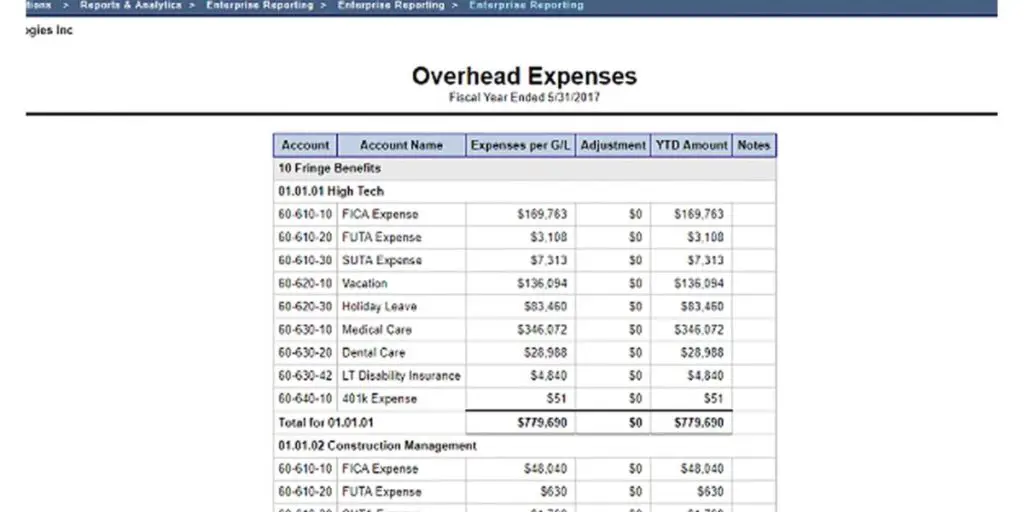

3. Deltek Costpoint

Deltek Costpoint is a government-approved accounting system that many businesses use to manage their finances.

It offers a variety of features that can help companies keep track of their spending, invoicing, and other essential data. However, a company’s accounting system must meet specific requirements to be approved by the DCAA.

Features

- Financial management from bid to invoice

- Segregate and allocate costs

- Accounting process automation

- Multi-company and currency compatibility

- Subcontractor management integration

Screenshots of Deltek Costpoint

Pricing

The vendor does not disclose pricing details. Instead, you need to get a quote by filling out a form on their website.

Supported industries

- Accounting and CPA

- Architecture and Engineering

- Consulting

- Government and Contracting

- Aerospace and Defense

- Energy, Oil, and Gas

Likes

Likes

- The software is user-friendly and easy to navigate.

- Numerous modules are available to learn and utilize.

- Extensive fields are available for data entry.

- Provides highly normalized database structure.

- Provides project-based accounting.

- Integrates with other products via built-in Web Services tool and multiple data pre-processors.

Dislikes

Dislikes

- Search features can be tricky at times.

- Slight learning curve for new users.

- Some aspects of the product are not intuitive.

- Certain processes can be time-consuming.

- Recent version upgrades have introduced new bugs.

- Bug fixes can take considerable time to be released.

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Supported device | Mac, Windows, Android, iPhone, iPad |

| Supported languages | German, English, French, Dutch |

| Support | 24/7 (Live Rep), Chat |

| Training | In-person, Live Online, Webinars, Documentation |

| Customer ratings | Capterra: 4.0 out of 5 (203+ reviews), G2: 4.0 out of 5 (203+ reviews) |

User opinion

It has significantly reduced the complexity of government accounting by consolidating project management, financials, and compliance into one powerful platform. Costpoint’s ability to centralize the management of projects, people, finances, and compliance is truly game-changing.

However, there are some drawbacks. The search features can be tricky at times, and new users may face a slight learning curve. Some aspects of the product are not intuitive, and certain processes can be time-consuming.

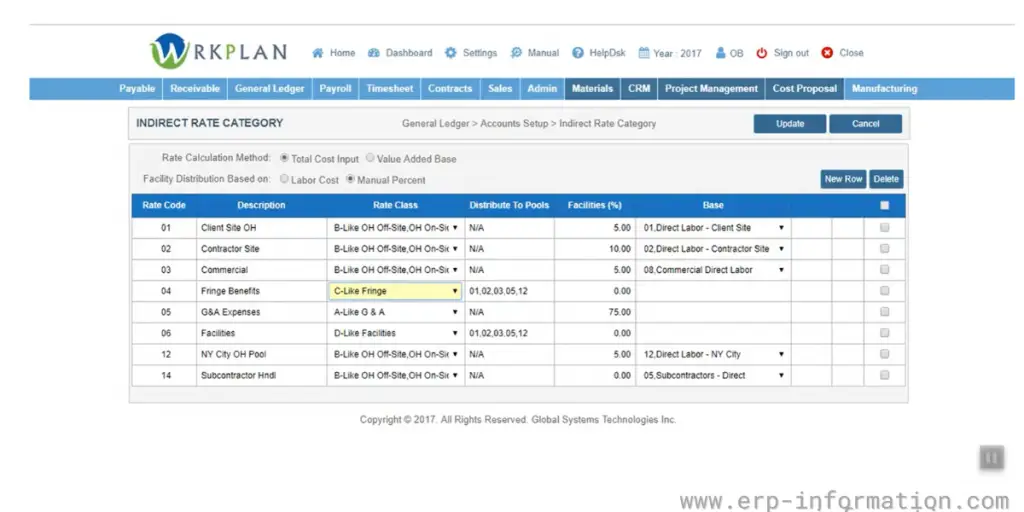

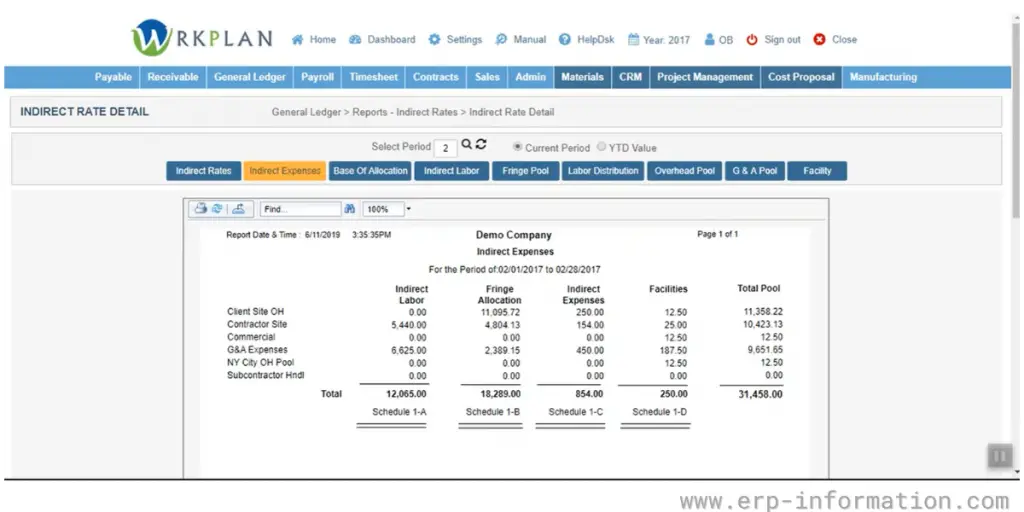

4. WrkPlan

WrkPlan is the perfect solution for businesses that need to track employee time and attendance. The web-based software is accessible from anywhere with an internet connection.

In addition, WrkPlan integrates with QuickBooks, making it easy to keep track of your finances. The software also complies with the DCAA requirements for an approved accounting system.

Features

- Government contract management

- Project billing and accounting

- Incurred cost submission

- Time and expenses

- Budgeting and forecasting

- Extensive reporting

Screenshots of Wrkplan

Pricing

The vendor does not provide the pricing details. To get pricing details, you need to contact the vendor directly.

Likes

Likes

- The software is easy to get started with.

- Exceptional customer service; questions are addressed within 24 hours by a human being.

- User-friendly interface for the ERP and timekeeping system.

- The timekeeping system includes a mobile app.

Dislikes

Dislikes

- Some accounting modules require many manual steps, especially for edits.

- Manual steps may be necessary to meet DCAA compliance.

Other details

| Deployment | Cloud, SaaS, Web-Based |

User opinion

WrkPlan is essential for ensuring DCAA compliance and streamlining operations. With fully integrated project accounting, contracts management, and timesheets, WrkPlan eliminates the hassle of juggling multiple systems and spreadsheets.

It provides the user-friendly interface of both the ERP and timekeeping systems. However, some of the accounting modules involve many manual steps, particularly when making edits.

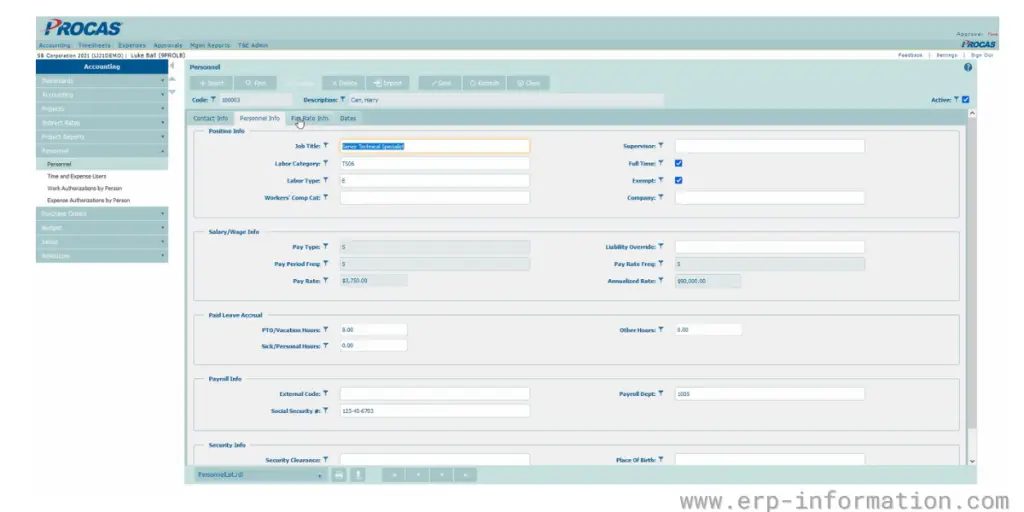

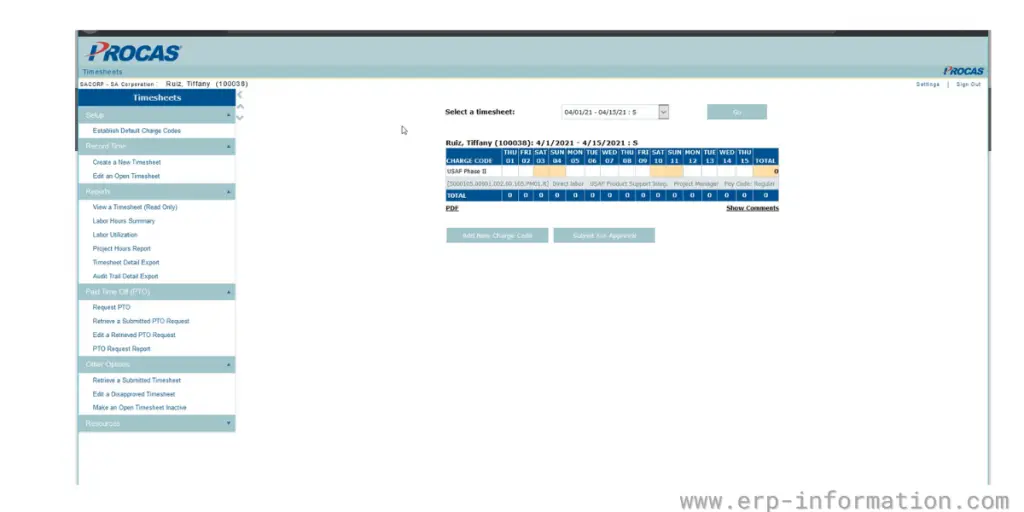

5. PROCAS

Procas is a leading software solution for government contractors. It is approved by the DCAA and meets all of their requirements for an accounting system.

Features

- Accounting

- Timekeeping

- Expense Reporting

- Management Report

- Web API For Business Intelligence Systems

Screenshots of Procas

Pricing

Pricing details are not publicly available. You need to contact the vendor to get details.

Likes

Likes

- User-friendly interface

Dislikes

Dislikes

- Issues in reporting.

- Lacks of standardization of report generation procedures across modules.

- Completing an expense report can be challenging due to the lack of clear instructions.

Other details

| Deployment | Cloud, SaaS, Web-Based |

| Support | Phone Support |

| Training | Live Online, Webinars, Documentation, Videos |

| Customer ratings | Capterra: 4.8 out of 5 (6+reviews), G2: 4.2 out of 5 (3+reviews) |

User opinion

It simplifies the business processes and allows you to focus on what matters most – delivering exceptional projects to clients. The integration of accounting, timekeeping, expense reporting, and project management all in one platform has truly streamlined operations.

It offers a user-friendly interface that makes navigation straightforward. However, there are some areas for improvement. Reporting issues and a lack of standardization across modules can make generating reports challenging. Additionally, completing an expense report can be difficult due to unclear instructions.

FAQs

What is the DCAA, and what does it do?

The DCAA is the Defense Contract Audit Agency, a government organization that audits government contractors to ensure they follow the rules and regulations for accounting and costing. As a result, contractors often find themselves in need of an accounting system that the DCAA approves.

What is DCAA Compliance?

DCAAs Compliance Program evaluates contractor performance to ensure that contractors meet their contracts’ requirements and applicable Federal Regulations. DCAA also provides education and guidance to contractors on how to comply with the regulations. So DCAA compliance means ensuring you follow the rules when performing a government contract.

What are the consequences of not having a DCAA Approved Accounting System?

The consequences of not having a DCAA approved accounting system can be significant. The most obvious impact is that you may not be able to get paid for your work on the contract.

The DCAA has specific requirements for what constitutes an approved system, and if your system does not meet these requirements, the DCAA may find that you are not in compliance with the contract. That could lead to fines, penalties, or even being banned from working on future government contracts.

Conclusion

The DCAA Approved Accounting System is critical software for businesses that contract with the government. However, the requirements and process to gain approval can be daunting.

The DCAA has specific requirements for what constitutes an approved accounting system. In this blog post, we’ve outlined those requirements and provided information on how to get your accounting system approved by the DCAA. We hope this helped you understand the platform!

Reference